Closed!

And this was in the good ol’ (pre-pandemic) days!

Quote of the Day

”No place affords a more striking conviction of the vanity of human hopes, than a public library.”

- Samuel Johnson

Musical alternative to the radio news of the day

Covita (the Covid adaption of Evita)

I know it’s political. But it is at least musical! It’s a creation of the Lincoln Project

Everything you needed to know about aerosol transmission of the virus but were too busy to ask

“FAQs on Protecting Yourself from COVID-19 Aerosol Transmission”

Prepared by a group of real experts. You can find it here. Great resource.

Thanks to Seb Schmoller for spotting it.

The Five Cs of Subwoofer Setup

I was idly thinking about how nice it would be to have a subwoofer as part of the audio system in our study. Having read this helpful guide I’ve decided that life’s too short, especially if it involves me having crawl around listening at the same level as the cats.

Trump’s antibody treatment was tested using cells originally derived from an abortion

The Trump administration has been trying to curtail research with foetal cells. But when it was life or death for the president, no one objected. Including, it seems, all those anti-abortion campaigners who support him.

This from Tech Review

This week, President Donald Trump extolled the cutting-edge coronavirus treatments he received as “miracles coming down from God.” If that’s true, then God employs cell lines derived from human fetal tissue.

The emergency antibody that Trump received last week was developed with the use of a cell line originally derived from abortion tissue, according to Regeneron Pharmaceuticals, the company that developed the experimental drug.

The Trump administration has taken an increasingly firm line against medical research using fetal tissue from abortions. For example, when it moved in 2019 to curtail the ability of the National Institutes of Health to fund such research, supporters hailed a “major pro-life victory” and thanked Trump personally for taking decisive action against what they called the “outrageous and disgusting” practice of “experimentation using baby body parts.”

Four Myths about Tech

Interesting paper from the Data & Society research institute.

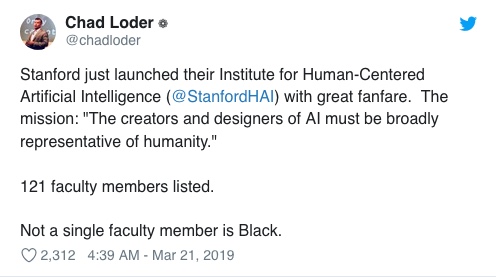

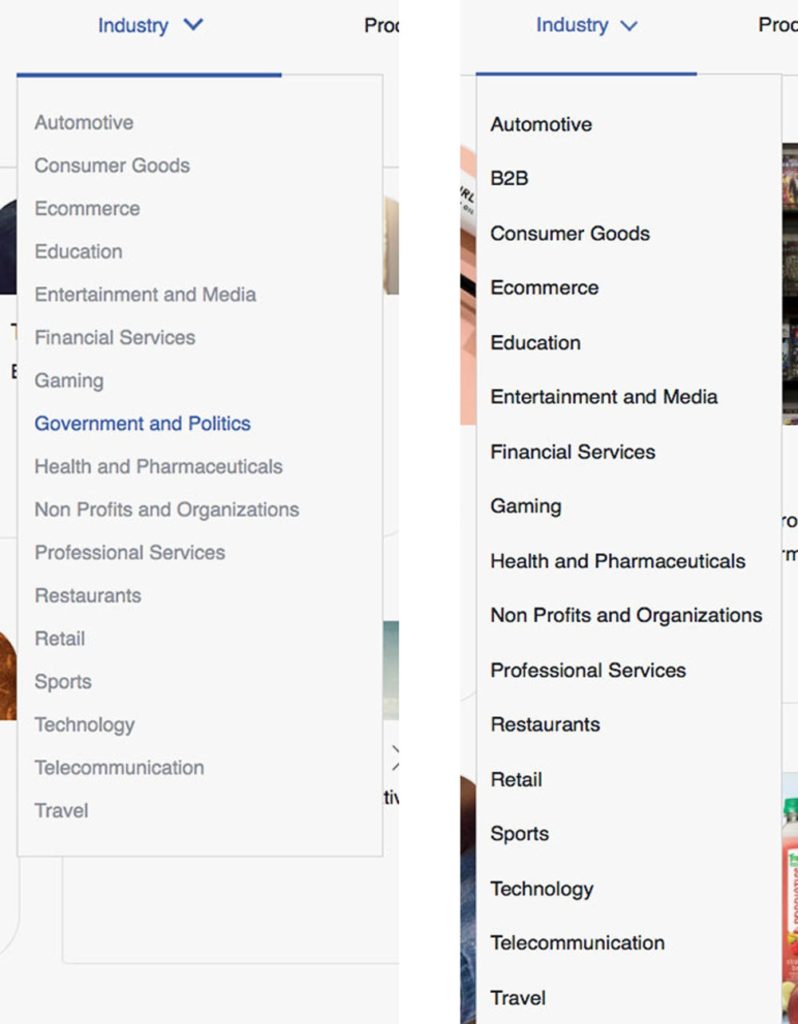

The tech companies that design and build so many of the devices, platforms, and software we use for hours each day have embraced myths that push a flawed under- standing of digital well-being. While we are encouraged that these companies are dedicating greater attention to social media’s effect on the mental and physical health of users, their current approaches to improving user well-being fundamentally misunderstand how people engage with technology. At its worst, this approach funnels time and resources to making technology more “enriching” for middle-class white users, while failing to address the systemic harms that minoritized communities face.

The authors see four particular kinds of myths:

- Social media is addictive, and we are powerless to resist it.

- Technology companies can fix the problems they create with better technology.

- Growth and engagement metrics are the best drivers of decision-making at tech companies.

- Our health and well-being depend on spending less time with screens and social media platforms.

These may sound counter-intuitive, so it’s worth reading the (short) paper to see their reasoning.

Basically, though, it’s really only relevant to the surveillance capitalism operators.

Recommended, nevertheless.

“Modelling anti-vaccine sentiment as a cultural pathogen”

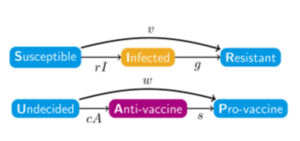

This is the title of a really interesting paper which was published last May in the journal Evolutionary Human Sciences. It’s by two Stanford researchers, Rohan Mehta and Noah Rosenberg, who wanted to understand the dynamic interactions between a pandemic and human behaviours related to the disease. So they defined anti-vaccine conspiracy theories, for example, or aversion to wearing a mask, as cultural pathogens which, when they spread through a population, can promote the spread of diseases. The question is: how do these interactions play out? What are their dynamics?

There’s a useful summary of the research published by Stanford University. Here’s a clip:

To couple the transmission of disease with the transmission of a sentiment, the researchers used what’s called an S-I-R model, which divides populations into groups, or “compartments” – namely those who are susceptible, infected and recovered. “The S-I-R model with one dimension for behavior and one dimension for disease is among the simplest ways to understand how the behavioral dynamics affect the disease dynamics,” said Rosenberg.

In the case of modeling anti-vaccination sentiment as a transmissible preference, this would mean susceptible individuals are undecided about vaccines; infected individuals are those who have the anti-vaccination sentiment; and recovered individuals are pro-vaccine and not susceptible to anti-vaccination sentiment.

There could realistically be a broad spectrum of feelings associated with any particular sentiment, but simplifying the model provides a clearer connection to disease dynamics. For example, individuals who are pro-vaccine could change their minds in the real world, but the model assumes they cannot (as if they have already been vaccinated as a result of their sentiments and cannot undo the action).

“We want these kinds of models to have some realism, but the more complicated we make them, the harder it is to fully understand all the potential behaviors that could emerge,” said Rosenberg. “The goal is to understand how phenomena affect each other, rather than to make projections. We see clearly in the model how anti-vaccination sentiment can promote spread of the disease for which the vaccine is being applied.”

The point of a study like this is that it tries to take a holistic or system-wide view of a problem. At the moment, we tend mostly to build models of how an epidemic spreads so that we can predict likely outbreak scenarios. But which scenario turns out to be accurate depends not just on the characteristics of the pathogen, but also on how the human population responds to these strange circumstances. This is why governments across Europe and elsewhere have been taken aback by the new surges in infections. The problem will get worse when credible vaccines for Covid-19 start to appear, because what happens from then on depends on how people respond to the possibility of vaccination. The disease modelled in the research reported in the journal article was measles, but of course the scenario that everyone would like to study relates to Covid. It seems that Stanford has given them more resources to work on that.

The Abstract for the paper reads:

Culturally transmitted traits that have deleterious effects on health-related traits can be regarded as cultural pathogens. A cultural pathogen can produce coupled dynamics with its associated health-related traits, so that understanding the dynamics of a health-related trait benefits from consideration of the dynamics of the associated cultural pathogen. Here, we treat anti-vaccine sentiment as a cultural pathogen, modelling its ‘infection’ dynamics with the infection dynamics of the associated vaccine-preventable disease. In a coupled susceptible–infected–resistant (SIR) model, consisting of an SIR model for the anti-vaccine sentiment and an interacting SIR model for the infectious disease, we explore the effect of anti-vaccine sentiment on disease dynamics. We find that disease endemism is contingent on the presence of the sentiment, and that presence of sentiment can enable diseases to become endemic when they would otherwise have disappeared. Furthermore, the sentiment dynamics can create situations in which the disease suddenly returns after a long period of dormancy. We study the effect of assortative sentiment-based interactions on the dynamics of sentiment and disease, identifying a tradeoff whereby assortative meeting aids the spread of a disease but hinders the spread of sentiment. Our results can contribute to finding strategies that reduce the impact of a cultural pathogen on disease, illuminating the value of cultural evolutionary modelling in the analysis of disease dynamics.

This blog is also available as a daily email. If you think this might suit you better, why not subscribe? One email a day, delivered to your inbox at 7am UK time. It’s free, and there’s a one-click unsubscribe if you decide that your inbox is full enough already!

__________________________