Quote of the Day

Trump has found a formula for success. 1. Wait for cop violence against black man. 2. Protests follow. 3. Trump shooters show up at protests. 4. People die. 5. Repubs say: Cities on fire! 6. Repeat. Not sure what the antidote is, or if there is one.

Me neither, other than if you’re an American citizen be sure to vote on November 3.

Musical alternative to the morning’s radio news

J. S.Bach: Sheep May Safely Graze – The Royal Philharmonic Orchestra

I love the comment below the video: “Hmm, at this tempo the sheep aren’t grazing, they’re mowing.”

If you think it’s too fast, there’s a lovely, more leisurely, piano version played by Alessio Bax here.

China Just Called Trump’s Bluff on TikTok

Interesting Bloomberg report.

I love this.

Imagine a bidder wanting to buy KFC, but being told the deal might not include the Colonel’s 11 secret herbs and spices. That’s effectively what Beijing has told the list of U.S. companies keen to purchase short-video app TikTok: The key ingredients may be out of reach.

China’s Commerce Ministry added new items to its list of export controls late Friday. Now, artificial intelligence interface technologies such as speech and text recognition, as well as methods to analyze data and make personalized content recommendations, are matters of national security.

That means ByteDance [TikTok’s owner] will need Chinese government approval to sell TikTok’s U.S. operations, Bloomberg News reported Sunday; a person familiar with the matter said the new rule is aimed at delaying the sale, not an outright ban. But with AI and its content recommendation engine among the key ingredients of the company’s success, Beijing becomes the arbiter of TikTok’s fate. Not the U.S. administration.

Two can play at the National Security game!

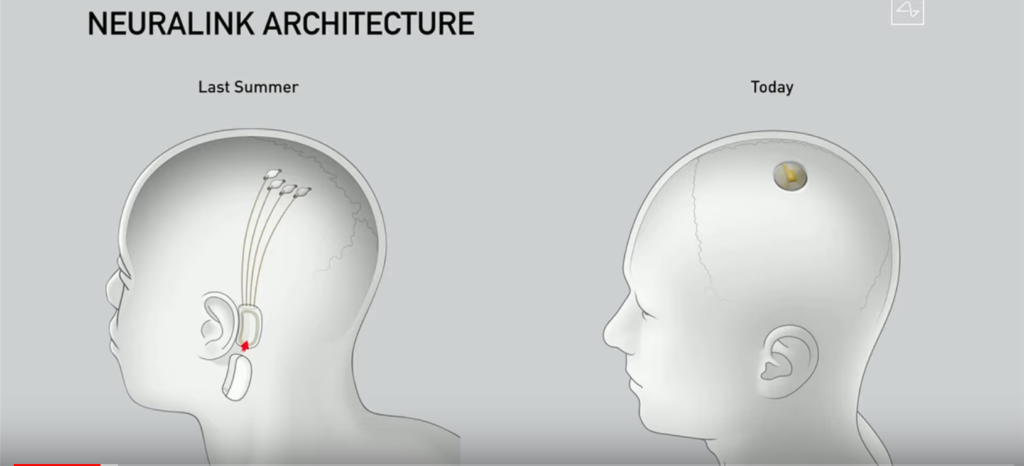

Elon Musk’s Neuralink neuroscience theatre

From an excellent Tech Review report.

In a “product update” streamed over YouTube on Friday, Musk, also the founder of SpaceX and Tesla Motors, joined staffers wearing black masks to discuss the company’s work toward an affordable, reliable brain implant that Musk believes billions of consumers will clamor for in the future.

“In a lot of ways,” Musk said, “It’s kind of like a Fitbit in your skull, with tiny wires.”

Although the online event was described as a product demonstration, there is as yet nothing that anyone can buy or use from Neuralink. (This is for the best, since most of the company’s medical claims remain highly speculative.) It is, however, engineering a super-dense electrode technology that is being tested on animals.

Musk’s presentation is surprisingly hesitant.

Personally, I am very interested in this stuff because I am not the world’s greatest multi-tasker. My way of accounting for this is to say that I’ve got the wrong multi-tasking algorithm. To which my friend Quentin once reassuringly replied: “Don’t worry, you can always be re-flashed.” And I thought he was joking.

How tech companies behave when they’re threatened

Anyone who thinks that tech companies are different from any other ruthless corporation hasn’t been paying attention. Here’s a revealing account of the lengths they will go to silence or derail critics.

That night, Dubal says she slept on the floor of her two eldest children’s shared room with a baby monitor close by. As she closed her eyes, she couldn’t stop thinking about the messages and tweets she’d been barraged with. “Vile Veena.” “Veena Dubal is insane! Let’s give her our piece of mind!” “She is a very annoying pest. Bring out some spray #veenadubal.”

Dubal says she had inadvertently been pulled into a bizarre world where people on Twitter and Facebook seemed to think she was behind a California law, Assembly Bill 5 (AB5), that addressed labor protections for gig workers. One of the main goals of AB5 was to get companies like Uber and Lyft — two of the world’s largest ride-hailing services that rely on the work of independent contractors — to reclassify their drivers as employees, so workers can get basic benefits like health care, sick leave and a minimum wage. The law was actually authored by Assemblywoman Lorena Gonzalez, a Democrat from San Diego, someone Dubal had met only a couple of times, in group settings.

Dubal is an outspoken supporter of AB5. She’s often quoted in the media, has written articles and op-eds, and has sent letters to unions, the California legislature and Congress to advocate in support of gig workers. But she says she had no hand in creating the law.

“So, where did the idea come from that I wrote the law?” Dubal says.

This idea might not have gone viral by accident, but rather by design.

Dubal seems to have become a target in a complex campaign involving social media harassment, take-down articles on conservative websites and actions by at least two public relations firms hired by Uber, Lyft, DoorDash, Instacart and Postmates. One of those PR firms, Sacramento-based MB Public Affairs, submitted a lengthy public records request on July 28 for Dubal’s email correspondence with 130 other labor activists, academics and union leaders.

Public records obtained by CNET from the California Secretary of State show the five gig economy companies hired the PR firms to work on a ballot measure campaign that’s up for a vote in California’s November election. The ballot measure, Proposition 22, was jointly sponsored by the five companies and aims to specifically exempt them from AB5. The proposition suggests creating an alternative to the law that keeps workers as independent contractors, but adds a few more benefits, such as expense reimbursement and a health care subsidy.

My view of tech firms is that they are indistinguishable from tobacco, oil and mining companies, i.e. intrinsically sociopathic and ruthless. And there isn’t a barrel they won’t scrape when threatened. We saw this on the Observer when we broke the Cambridge Analytica story. Facebook’s legal and other actions that Friday night provided a master-class in corporate viciousness.

This blog is also available as a daily email. If you think this might suit you better, why not subscribe? One email a day, delivered to your inbox at 7am UK time. It’s free, and there’s a one-click unsubscribe if your decide that your inbox is full enough already!