Why the ‘Internet of Things’ will take a while to arrive

Nice sceptical piece in the Economist:

Many smart gadgets are still too expensive. One of Samsung’s smart fridges, with cameras within that check for rotting food and enable consumers to see what they are short of while shopping (through an app on their phone), sells for a cool $5,000. People who can afford that probably don’t do their own shopping.

Worth reading in full.

The spy in the cab

Interesting news for Tesla owners:

Everyone makes mistakes, and many people try to cover them up. But if you try to hide an error made behind the wheel of a car made by Tesla Motors, you are liable to be caught out. In fact, trying to hide what really happened in any kind of car accident could soon become just about impossible.

That’s the lesson of an incident over the weekend in which the owner of a Tesla Model X SUV crashed into a building and claimed it had suddenly accelerated on its own. But Tesla vehicles are constantly connected to their manufacturer via the Internet, and the company had this to say in a statement to the Verge:

“Data shows that the vehicle was traveling at 6 mph when the accelerator pedal was abruptly increased to 100 percent … Consistent with the driver’s actions, the vehicle applied torque and accelerated as instructed.”

Quite so. So what happens when your Tesla has been hacked and the hacker instructs it to accelerate into a wall? Or into a crowd?

High Summer

Wimpole Hall grounds. Larger size here

So what was Google smoking when it bought Boston Dynamics?

This morning’s Observer column:

The question on everyone’s mind as Google hoovered up robotics companies was: what the hell was a search company doing getting involved in this business? Now we know: it didn’t have a clue.

Last week, Bloomberg revealed that Google was putting Boston Dynamics up for sale. The official reason for unloading it is that senior executives in Alphabet, Google’s holding company, had concluded (correctly) that Boston Dynamics was years away from producing a marketable product and so was deemed disposable. Two possible buyers have been named so far – Toyota and Amazon. Both make sense for the obvious reason that they are already heavy users of robots and it’s clear that Amazon in particular would dearly love to get rid of humans in its warehouses at the earliest possible opportunity…

The Chinese economic miracle, Part 2

The Chinese economic miracle is built on cheap and dextrous manual labour. But labour costs are rising sharply, so…

China already imports a huge number of industrial robots, but the country lags far behind competitors in the ratio of robots to workers. In South Korea, for instance, there are 478 robots per 10,000 workers; in Japan the figure is 315; in Germany, 292; in the United States it is 164. In China that number is only 36.

The Chinese government is keen to change this.

You bet they are. But what happens to all the folks who no longer have work? Stay tuned.

The interesting case of the Internet’s ‘i’

The AP style book now says that the Internet should no longer be capitalised.

Vint Cerf, the co-designer of the network, disagrees.

The editors at AP fail to understand history and technology,” Cerf told Politico on Wednesday (June 1). His beef is that there has always been a line between the public internet and a private internet that has no connection to the outside world, although it shares the same TCP/IP protocols. This, he warns, is simply daft. “By lowercasing you create confusion between the two and that’s a mistake,” he wrote.

I agree.

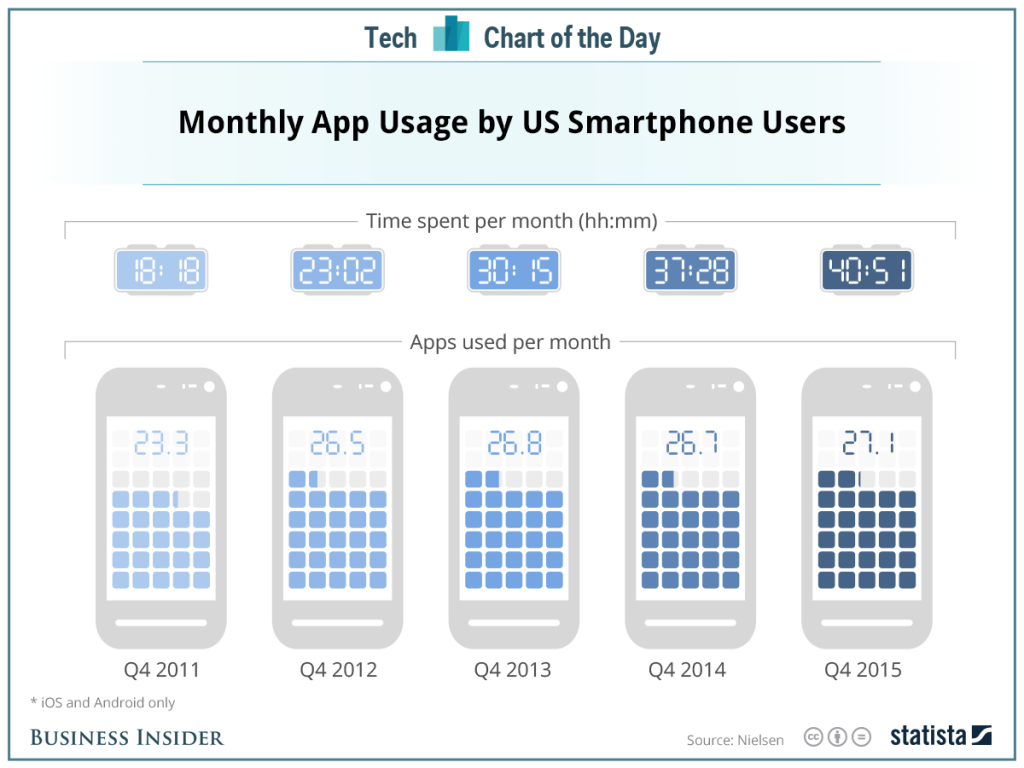

The app explosion is over

How to manage the Internet – part 2

This morning’s Observer column:

If you ever wanted an illustration of why academic research is not just important but vital, then the work of Gary King, professor of sociology at Harvard, could serve as exhibit A. Why? Well, one of the more pressing strategic issues that faces western governments is how to adjust to the emergence of China as a new global superpower. The first requirement for intelligent reorientation is a rounded understanding of this new reality. And while it may be that in the foreign offices and chancelleries of the west officials and policy makers are busily boning up on Chinese industrial and geopolitical strategy (what the hell are they up to in the South China Sea, for example?), I see little evidence that anyone in government has been paying attention to how the Beijing regime seems to have solved a problem that no other government has cracked: namely, how to control, manage and harness the internet for its own purposes.

Strangely, our rulers still seem blissfully unaware of this, which is odd because – as I pointed out ages ago – there’s no longer any excuse for ignorance: Professor King has done most of the heavy lifting required…