Say cheesy

A snip from the specification of the SONY Cybershot T70 compact digital camera.

Technology, said Heidegger, “is the art of arranging the world so that one doesn’t have to experience it”. Cue some of the new SONY Cybershot range which come equipped with a ‘smile shutter’ that recognises grinning subjects and then automatically takes a shot. Apparently, when several people are in the shot, the shutter only fires when the main subject – who must be manually selected – smiles. A sequence of six smile shots can be taken without manually pressing the shutter.

Jackie Stewart shares his, er, secrets of success

It’s pass the sickbag time again, folks. The diminutive Scottish petrolhead with the whiny voice has been sharing the secrets of his success with the unfortunate readers of the Torygraph.

The great challenge, he explains, “is to win with integrity and care.”

“Integrity and care?” some will jeer. [Ed: shurely not]. “They don’t count. Look at the scoreboard. It’s a dog-eat-dog world out there, and the reality is, in sport, business and everything else, that nice guys come last. Winning is not everything, it’s the only thing,” and so on. I disagree.

As a sportsman I was hideously spoiled. It’s easy for pampered heroes to believe the world owes them a living – until the adulation ends soon after they retire.

The key to success after sport lies in stopping being a taker and learning to be a giver. In my case, the realisation that I could add significant value to companies providing products or services to motorsport dawned long before I retired from racing in 1973. So, when the time came, I was able to move seamlessly from the cockpit into a series of long-term associations with companies including Ford, Goodyear, Rolex and Moët & Chandon. My aim was always to provide more value than they perceive they were paying for…

Aw, isn’t that sweet! Imagine someone generous enough to give to penniless outfits like Rolex and Moet & Chandon. Altruism is so ennobling, don’t you think.

Who reads this ‘inspirational’ crap, I wonder? (Apart from me, that is.)

Good news for air-guitarists

From Technology Review…

It’s every guitar player’s nightmare: you step onstage, strike your rock-god pose, triumphantly strum the first chord of a song–and discover that your guitar is out of tune.

A new line of instruments from Gibson Guitar now promises to banish this scenario to the dark ages with high-tech self-tuning technology built into the company’s flagship electric-guitar models.

The idea is drawing both kudos and criticism from guitar professionals and purists. On blogs and forums around the Web, some players call it an inexcusable crutch for sloppy players. Others, particularly those who use different tunings for different songs, say it could be a godsend.

Either way, the system is a sign that the music world’s digital transformation is reaching ever deeper, even into the rarefied circles of high-end analog instruments…

eBay: we goofed

From Good Morning Silicon Valley…

Today, in what will undoubtedly be a blow to the Skype founders’ seller rating, eBay finally acknowledged that its bid for the VoIP firm may have been a tad overenthusiastic and that whatever expectations it had were not being met. EBay announced that in the quarter just ended, it will take $1.4 billion in write-offs and charges related to the Skype acquisition. About $530 million will go to former Skype shareholders to help them forget about those additional performance-based payouts. And eBay will write off about $900 million in Skype-related “goodwill” to more accurately reflect the acquisition’s value. And just in case the message wasn’t clear, Skype co-founder Niklas Zennstrom was eased out of the CEO’s office and given the non-executive chairman’s seat at the Skype board table.

Wow!

That still leaves open the question of what eBay ought to do with its tarnished toy, and Henry Blodget has an answer: sell it to someone who could put it to use, like Yahoo, Microsoft or Google.

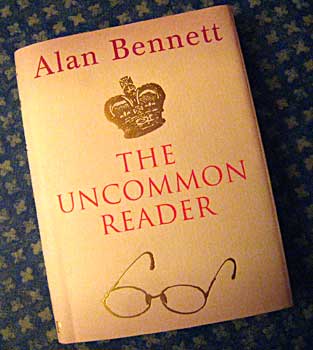

This year’s Xmas book

Every Christmas there’s a book which takes the UK market by storm. It’s the book that everyone thinks someone else would like to read — the perfect literary stocking-filler. In earlier years it was Lynne Truss’s Eats Shoots and Leaves and Schott’s Miscellany.

I’ve just finished what I predict will be this year’s Christmas Book. It’s Alan Bennett’s delicious fantasy about what would happen if HM the Queen became a serious reader. Here she is explaining Proust to the (baffled) Foreign Secretary:

“Terrible life, poor man. A martyr to asthma, apparently, and really someone to whom one would have wanted to say, ‘Oh do pull your socks up.’ But literature’s full of those. The curious thing about his was that when he dipped his cake into his tea (disgusting habit) the whole of his past life came back to him. Well, I tried it and it had no effect on me at all. The real treat when I was a child was Fuller’s cakes. I suppose it might work with me if I were to taste one of them, but of course they’ve long since gone out of business, so no memories there. Are we finished?”. She reached for her book.

124 pages of pure, unadulterated bliss. If I were a screenwriter I’d be working on the adaptation now.

The Brooning of Labour

If, like me, you were repelled by the unctuous vapouring of Gordon Brown’s Conference Speech, then you’ll enjoy Ross McKibbin’s acerbic commentary in the current LRB. Sample:

How problematic Brown’s policies were and are has been demonstrated by the Northern Rock affair. In the short term, of course, its difficulties were not the doing of the government. Northern Rock was the victim of a crisis in the international banking system caused by unwise mortgage lending in the United States. In the longer term, however, Brown, New Labour and much of the country’s political and financial elite have acquiesced, with more or less enthusiasm, in a financial regime which began in this country with the abolition of credit restrictions by the Thatcher government. Although there were arguments in favour of abolition it was always very risky – just as the present colossal levels of personal indebtedness (essential to Labour’s electoral success) are very risky. That it came to a run on a bank – something that has not happened in Britain for 150 years, not even in the international financial crisis of 1931 when the stability of the British banking system was the wonder of the world – shows how instinctively (and understandably) nervous people are of this regime. Furthermore, Brown’s system of regulation worked badly. It was he who divided regulatory responsibility between the Financial Services Authority and the Bank of England – which was asking for trouble – and it was he who extended the autonomy of the Bank, with predictable results.

The truth is that — as McKibbin points out — much of what is most detestable about New Labour — its authoritarianism, contempt for civil liberties, adulation of ‘wealth creation’, micromanagerial obsessiveness over ‘targets’, PFI, etc. — are actually more Brown’s creations than Blair’s. The only difference is that Brown is now varnishing them with a new layer of patriotic tosh about “Britishness”, “British values”, etc. If the Tories weren’t so pathetic there might be some hope of unhorsing the pompous ass.

Google’s secret sauce

Pascal Zachary get it right, IMHO:

Consider the question of Google’s greatest business secret. Is it the algorithms behind its search tools? Or is it the way it organizes vast clusters of computers around the globe to answer queries so quickly? Perhaps predictably, Google won’t disclose the number of computers deployed in its vast information network (though outsiders speculate that the network has at least 450,000 computers).

I believe that the physical network is Google’s “secret sauce,” its premier competitive advantage. While a brilliant lone wolf can conceive of a dazzling algorithm, only a superwealthy and well-managed organization can run what is arguably the most valuable computer network on the planet. Without the computer network, Google is nothing.

Eric E. Schmidt, Google’s chief executive, appears to agree. Last year he declared, “We believe we get tremendous competitive advantage by essentially building our own infrastructures.”

So, … XP stands for ‘extended presence’, right?

Well, well. Microsoft bows to pressure on XP…

Customer demand has forced Microsoft to extend the shelf life of Windows XP by five months.

Microsoft was scheduled to stop selling the six-year-old operating system on 30 January 2008 to leave the field clear for Vista.

Now the date on which many sellers of XP will no longer be able to offer it has been lengthened to 30 June 2008.

Microsoft said the change was to help those customers that needed more time to make the switch to Vista.

Ho, ho!

Taking people at their Facebook value

This morning’s Observer column…

To the old question: what are friends for? we must now add: how much are they worth? This is topical because rumours abound that Microsoft is contemplating buying a stake in Facebook, the social networking site. The really interesting bit is the arithmetic. Microsoft is supposedly contemplating paying between $300m (£147m) and $500m for a 5 per cent share. If true, this suggests that its advisers put a value of between $6bn and $10bn on Facebook. Google is also reported to be sniffing around, raising the prospect of a bidding war for a website which essentially enables people to post embarrassing photographs and impress acquaintances with accounts of their busy lives…