From a blog post by Dan Ariely entitled “7 Habits of Highly Ineffective People”.

Category Archives: Asides

Tony Blair, technophile (for a fee)

This morning’s Observer column.

“Blair to join venture firm as adviser on technology” said the headline in the New York Times. Eh? The first thing that came to mind is the celebrated story of the emperor Caligula and his attempts to have his horse, Incitatus, appointed as a consul. Anyone familiar with our former prime minister’s encounters with technology one thinks, for example, of the time he tried to order flowers for Cherie over the web will have been puzzled by this development. Tony has many talents, but the one thing he doesn't do is technology.

So who’s playing Caligula in this particular farce? Answer: Vinod Khosla, an Indian-American venture capitalist with impeccable academic and technology credentials, who now runs a $1bn fund that invests in ‘green’ technology aka cleantech and IT…

Going the distance

So who’s really behind the anti-BP hysteria in the US?

The answer, as hinted in this NYTimes piece, is Exxon, which sees a once-in-a-lifetime chance to exterminate a commercial rival.

The idea that BP might one day file for bankruptcy, particularly as part of a merger that would enable it to cordon off its liabilities from the spill, is starting to percolate on Wall Street. Bankers and lawyers are already sizing up potential deals (and counting their potential fees).

Given the plunge in BP’s share price — the company has lost more than a third of its value since Deepwater Horizon blew — some bankers and analysts say BP is starting to look like takeover bait. The question is, who would buy BP, given its enormous potential liabilities?

Shell and Exxon Mobil are both said to be licking their chops. And already, flinty legal minds are dreaming up scenarios in which BP would file a prepackaged bankruptcy and separate the costs of the cleanup — and potentially billions of dollars in legal claims — into a separate corporate entity.

Supreme Court website cost £360,000 to build

Yep. According to an FoI request by the Guardian.

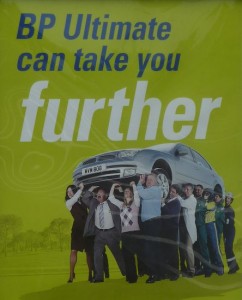

BP: beyond irony

Stephen Hsu posted this image on his blog under the heading “BP advertisement from 1999”. The date (1999) seems improbable, in that BP didn’t enter the US market until 1998 (when it merged with Amoco) and the logo wasn’t launched until the company rebranded itself as BP plc in 2001. That doesn’t mean that the image of the ad is faked, only that the date attributed to it is wrong. Whatever the truth of the matter, it’s clever.

LATER: Mystery solved. Dermot Casey tweets that it’s from a t-shirt made by Despair Inc..

The Pain Caucus

Further to my musings about the new definition of ‘courage’ as the willingness to inflict financial pain on others, here’s an interesting NYT column by Paul Krugman.

The extent to which inflicting economic pain has become the accepted thing was driven home to me by the latest report on the economic outlook from the Organization for Economic Cooperation and Development, an influential Paris-based think tank supported by the governments of the world’s advanced economies. The O.E.C.D. is a deeply cautious organization; what it says at any given time virtually defines that moment’s conventional wisdom. And what the O.E.C.D. is saying right now is that policy makers should stop promoting economic recovery and instead begin raising interest rates and slashing spending.

What’s particularly remarkable about this recommendation is that it seems disconnected not only from the real needs of the world economy, but from the organization’s own economic projections.

Thus, the O.E.C.D. declares that interest rates in the United States and other nations should rise sharply over the next year and a half, so as to head off inflation. Yet inflation is low and declining, and the O.E.C.D.’s own forecasts show no hint of an inflationary threat. So why raise rates?

The answer, as best I can make it out, is that the organization believes that we must worry about the chance that markets might start expecting inflation, even though they shouldn’t and currently don’t: We must guard against “the possibility that longer-term inflation expectations could become unanchored in the O.E.C.D. economies, contrary to what is assumed in the central projection.”

With one bound, the Times’s law-blogger is free!

Well, well. BabyBarista, whose witty law blog has hitherto been a must-read on the Times site, has jumped ship.

I have today withdrawn the BabyBarista Blog from The Times in reaction to their plans to hide it away behind a paywall along with their other content. Now don’t get me wrong. I have absolutely no problem with the decision to start charging. They can do what they like. But I didn’t start this blog for it to be the exclusive preserve of a limited few subscribers. I wrote it to entertain whosoever wishes to read it. Hence my decision to resign which I made with regret. I remain extremely grateful to The Times for hosting the blog for the last three years and wish them luck with their experiment. I hope very much you like the new site and also the addition of the wonderful cartoons by Hollywood animator Alex Williams who also draws the Queen’s Counsel cartoons for The Times.

Good for him.

LATER: Just noticed that Roy Greenslade has more on this. It seems that BabyBarista (aka Tim Kevan) has some reservations about the Murdoch paywall:

I think the decision will prove to be a disaster. There are so many innovative ways of making cash online and the decision to plump for an across-the-board blanket subscription over the whole of their content makes them look like a big lumbering giant, unable to cope with the diversification of the media brought about by online content, blogging, Facebook, Twitter – the list is endless.

Canute-like in their determination to stop the tide of free content and using a top down strategy which makes even the Post Office look dynamic.

Now for the next interesting question: what will Mary Beard, the Cambridge Professor of Classics, do? Her blog has hitherto been the other reason for reading the Times.

Pigeon held in India on suspicion of spying for Pakistan

No, I have not made this up. It was in the Daily Telegraph, so it must be true, mustn’t it?

Indian police are holding a pigeon under armed guard after it was caught on an alleged spying mission for arch rivals and neighbours Pakistan, according to reports in local media.

Published: 4:33PM BST 28 May 2010

The white-coloured bird was found by a local resident in India's Punjab state, which borders Pakistan, and taken to a police station 25 miles from the capital Amritsar.

The pigeon had a ring around its foot and a Pakistani telephone number and address stamped on its body in red ink.

Ramdas Jagjit Singh Chahal, a police officer, said he suspected that the pigeon had landed on Indian soil from Pakistan with a message, although no trace of a note has been found.

Officials have directed that no-one be allowed to visit the pigeon, which police say may have been on a “special mission of spying”.

The bird has been medically examined and was being kept in an air-conditioned room under police guard.

Senior officers have asked to be kept updated on the situation three times a day, according to a report from the Press Trust of India (PTI) news agency.

What motivates us?

As a co-founder and director of a technology start-up, I’ve thought a lot about what motivates staff. And I’ve been puzzled for years by a contradication that I’ve continually encountered. I’ve known lots of successful people in my time, and yet I cannot think of a single one who’s been primarily motivated by financial incentives. That’s not to say that they don’t like earning a decent salary, just that they’re not driven by money. And yet in business — and, during the New Labour years at least — in the public services also, the conventional wisdom is that financial incentives are the way to get higher performance from staff.

So you can see why I was fascinated by this cleverly-illustrated version of Daniel Pink’s RSA lecture about motivation, which is based on his book Drive: The Surprising Truth About What Motivates Us. (Full lecture here.) The essence of it is that financial incentives and penalties work well for jobs/tasks that are dull and repetitive and impose a low cognitive load on those who do them. But the minute one’s dealing with roles which are intellectually challenging, then the carrots-and-sticks approach fails.

Interesting, don’t you think? It becomes even more interesting when one sees that Neil Davidson, the co-founder of Red Gate Software, one of the most interesting and admired companies in Cambridge, decided to abandon the complex commission structure the company had developed to motivate its salesforce and replace it with a system based on (increased) flat salaries. Guess what? It works just fine, and Red Gate is taking its market by storm.

Now, here’s the really interesting bit. You may remember that whenever the issue of paying obscene bonuses to investment bankers is raised, we are solemnly informed by the directors of publicly-rescued banks that it’s essential to continue to pay said bonuses because otherwise the aforementioned wizards will go elsewhere. The clear inference is that they are entirely motivated by financial incentives, viz bonuses. But if it’s really true that financial incentives are what motivates bankers, then doesn’t it follow that the work they do is repetitive, dull and imposes a low cognitive load? And if that is indeed the case, then why don’t we just replace them with software and have done with the whole grisly business?