Happy Bloomsday! Interesting to see that the only reference to it in today’s Irish Times is to the fire aboard a New York ferry, the General Slocum, on June 16, 1904 — the original Bloomsday — whereas in the boom years of the Celtic Tiger affluent Dublin went en fete on June 16, with even property developers miming a literary sensibility and the Times always having something about the day on the front page.

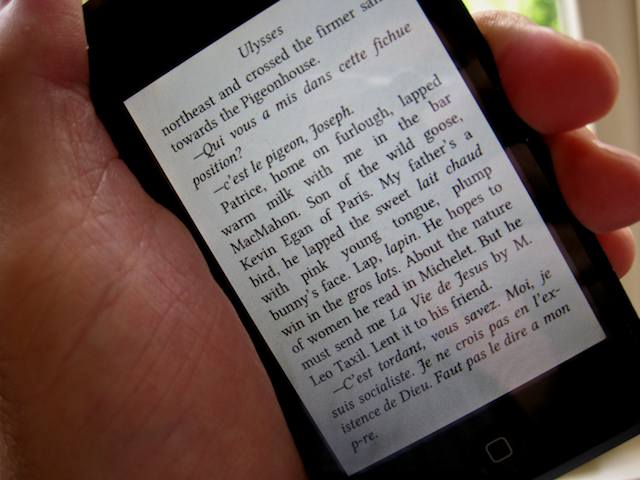

Perhaps it’s all an indication that my countrymen have a lot on their minds besides literature, what with the banking catastrophe and the child abuse revelations and all. So, as this blog’s modest contribution to the festivities, here is a (rare) audio recording of the Man Himself. When I first heard it I was astonished to find that he had a broad Irish-country accent. I had always imagined him speaking as a ‘Dub’ — i.e. with the accent of most of the street characters in Ulysses.

CORRECTION: I was unfair to the Irish Times — but only discovered my error when I picked up a paper copy in town after I’d written the post. There’s a lovely Irishman’s Diary by Terence Killeen about the Professor McHugh character who appears in Episode 7 of Ulysses. He was, in fact, ‘Professor’ MacNeill, a down-and-out who spent most of his days in the paper’s newsroom.

LATER: Hmmm… Interesting developments. At some stage in the morning, the Irish Times web page was updated with this fetching image of a Sandycove publican dressed to the Joycean nines.

Wondered what triggered the change? Could it have anything to do, one wonders, with the fact that this post was picked up by BoingBoing?

Thanks to Des Fitzgerald for the tip.