Just noticed this. Mac version coming soon, apparently. They’re clearly rattled by the upcoming Apple Tablet.

Ofcom knocks back BBC DRM plans

Tentative sign that sanity might prevail?

BBC plans to copy protect Freeview high definition (HD) data have been dealt a blow by regulator Ofcom. It has written to the BBC asking for more information about what the benefits would be for consumers.

Initially it looked as if Ofcom would approve the plans but, during its two week consultation, it has received many responses opposing the plan.

Critics say a Digital Rights Management (DRM) system for Freeview HD would effectively lock down free BBC content.

In its submission to Ofcom, the Open Rights Group argued that such a system was DRM by the “backdoor” and that it would prevent things such as recording HD content for personal use.

“Ofcom received a large number of responses to this consultation, in particular from consumers and consumer groups, who raised a number of potentially significant consumer ‘fair use’ and competition issues that were not addressed in our original consultation,” the letter from Ofcom to the BBC read.

It asked the BBC to clarify the benefit to citizens, as well as outline how it proposes to address the “potential disadvantages” and offer alternative approaches to the issue.

Two cheers, then. But the forces of darkness aren’t routed yet.

The Digger’s logic: cut off your nose to spite your face

In that already-notorious interview, Murdoch says he’s considering blocking Google from accessing NewsCorp sites. In that context, this Hitwise chart is interesting. It shows the percentage of WSJ traffic that is driven by Google searches.

“In fact”, says Bill Tancer of Hitwise,

“on a weekly basis Google and Google news are the top traffic providers for WSJ.com account for over 25% of WSJ.com’s traffic. Even more telling. According to Experian Hitwise data, over 44% of WSJ.com visitors coming from Google are “new” users who haven’t visited the domain in the last 30 days.”

All of which makes one wonder what the Digger’s been smoking.

An open letter to the Digger

Nice Crikey post.

Now this morning, Mr Murdoch, I wanted to make sure I wasn’t misrepresenting your comments. Rather than watch your full 37-minute interview with Sky News Australia — deadlines, deadlines! — I wanted a news report.

I went to Google News and typed “murdoch block google”. The first result was this story at the UK’s Telegraph.

I went to Microsoft’s Bing and typed the same thing. Their top link was this story at the Guardian.

(I also searched the news at Yahoo!7 and their one and only result was a Crikey story from a month ago. Fail.)

I clicked through and read their stories — you don’t see full stories in search engines, Mr Murdoch, you have to click through. I saw their adverts. They got traffic.

Do you own the Telegraph or the Guardian, Mr Murdoch?

Oh dear.

C’mon Digger: bring on yer paywall! We need this experiment.

En passant:I see from his newsletter that Jason Calcanis is pushing the idea that Microsoft should pay publishers to let Bing index their content as a way of screwing Google. Stand by for an outbreak of my-enemy’s-enemy-is-my-friend syndrome. I suspect that we’re approaching the point where Murdoch & Co will discover the full power of network effects.

LATER: Cory Doctorow has a lovely column in the Guardian about Murdoch’s increasingly erratic pronouncements. Excerpt:

Rupert has got dealmaker’s flu, a bug he acquired when he bought MySpace and sold the exclusive right to index it to Google. This had the temporary effect of making Rupert look like a technology genius, as Google’s putative payout for this right made the MySpace deal instantly profitable, at least on paper; meanwhile, MySpace’s star was in decline, thanks to competition from Facebook, Twitter and a million me-too social networking tools.

It also put ideas into Rupert’s head.

You can practically see the maths on the blackboard behind his eyelids: Exclusive deals + paywalls = money.

I think that Rupert is betting that one of Google’s badly trailing competitors can be coaxed into paying for the right to index all of Newscorp’s online stuff, if that right is exclusive. Rupert is thinking that a company such as Microsoft will be willing to pay to shore up its also-ran search tool, Bing, by buying the right to index the fraction of a fraction of a sliver of a crumb of the internet that Newscorp owns.

They’ll be able to advertise: “We have Rupert’s pages and Google doesn’t, so search with us!” (Actually, they’ll have to advertise: “We have Rupert’s pages and Google doesn’t, except MySpace, which Google has.”)

Or maybe not – MySpace isn’t delivering the traffic Rupert guaranteed Google in his little deal, and Google may bail if there’s a likely sucker on the line.

Maybe the target isn’t Microsoft. Maybe it’s some gullible startup that’s even now walking up and down Sand Hill Road, the heart of Venture Capital Country in Silicon Valley, showing off a PowerPoint deck whose entire message can be summarised as: “You give us a heptillion dollars, we’ll do exclusive search deals with Rupert and the other media behemoths, and we’ll freeze Google out.”

Murdoch is a bit like a malign version of Warren Buffett, in the sense that people are so impressed/intimidated by his past record that they’re reluctant to criticise him now. Like Buffett, the Digger has made great bets in his time (e.g. buying the Sun< and turning it round, launching Sky, etc.) and some of them required stamina and courage to seem them through. So at the moment even though most people don’t believe that his paywall strategy can work in a networked ecosystem, they have a kind of superstitious reluctance to express their scepticism out loud.

How Waterstone’s killed bookselling

Excellent (and somewhat depressing) Guardian piece by Stuart Jeffries on what happened to Waterstone’s.

Waterstone's has embraced capitalism’s logic firmly. Even in this Gower Street branch, with its five miles of bookshelves at the heart of London’s university quarter and in an area denser with literary heritage than perhaps any in the world, discounted piles of Leona Lewis biographies and Frankie Boyle’s My Shit Life So Far sit on the tables with the latest JM Coetzee. This lunchtime, the three-for-two tables are ringed by shoppers clutching two books and wondering if they can find a freebie worth reading. Here on the ground floor, the discounting of book prices is so ferocious that if you leave having paid the RRP you feel a right mug.

“They simply treat books as a commodity,” says Nicholas Spice, publisher of the London Review of Books, and one of the chain’s sternest critics. “There’s no sentiment to it. If it’s celebrity biographies that are going to sell, then that’s what they’ll focus on. They’re not looking at it from a cultural perspective.”

What does he expect? It’s a public company, driven by the need to maximise “shareholder value”.

Thanks to Lorcan Dempsey for the link.

Unicycling money

The kind of lunacy on display any day of the week in Covent Garden. A chap on a unicycle who is trying to escape from a straitjacket. And a small person plus mother who is contributing to his upkeep.

Flickr version here.

Berlin Rock

This is my piece of the Berlin Wall. It normally sits on the windowsill of my study. I would like to have been in Berlin yesterday, to celebrate the 20th anniversary of the crumbling of the wall, but had carelessly allowed my passport to expire and was in London getting a new one. Still…

One thing really pleased me, though — that Mikhail Gorbachev was there, and was properly honoured by Angela Merkel. If the story of the disintegration of the original ‘Evil Empire’ has a single hero, then it’s Gorby. “His achievement”, commented the Economist last week,

“was not in making great intellectual discoveries, but in spelling out publicly what people had said and thought in their Moscow kitchens for years: that people in the West lived better than in the Soviet Union, that the Soviet economy was inadequate and that ‘we can’t go on living like this any more.’ This was common sense. Saying it openly, however, was a breakthrough.”

This triggers a rueful thought: Gorbachev was a lot more perceptive than yours truly. In 1977-78 I was a Research Fellow at a Dutch university. One of my fellow academic visitors was a Soviet scientist. He was a Vice-President of the Soviet Academy of Sciences, which meant that in those days he was a Very Big Cheese indeed. (Once, with a single telephone call, he had several seats cleared from an overbooked Aeroflot flight to make space for a friend of mine who was visiting Georgia.) Before he returned to Moscow, he and I had a coffee together. I asked him whether there was anything he would miss from his Dutch sojourn when he returned home. “Oh yes”, he said, “the photocopier”.

“Eh?” I replied, baffled.

He went on to explain that he regularly spent two days a week in periodical libraries back home copying out extracts from scientific papers in longhand. “You see”, he went on, “in my country photocopiers are regarded as devices that need to be strictly controlled. They can be publishing machines for samizdat.”

At that point I ought to have twigged that the Soviet system was doomed. If it couldn’t handle routine information technology like photocopying (and FAX) then it would be unable to modernise. So it was only a matter of time before it crumbled.

As I say, I ought to have spotted that. But it was only years later that the significance of the conversation really dawned on me. Gorbachev’s genius was that he saw the problem, understood what it meant — and had the courage to state the obvious. That, and his refusal to use force to save Honecker in East Germany, were the critical factors in the remaking of European history that took place twenty years ago. But he’s been effectively written out of the story. Which, I suppose, was predictable. History, after all, is usually written by the victors.

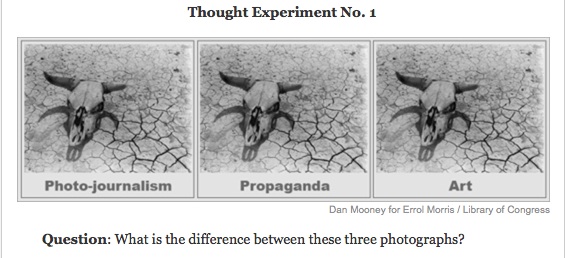

A thought experiment

From a thought-provoking essay by film-maker (The Fog of War, etc.) Errol Morris.

Back to the Future

Covent Garden, London, yesterday. Flickr version here.

Here comes the Sun

Apropos my musings about the evocative power of the Beatles’ Here Comes the Sun, this wonderful little chap emerged just before dawn on Saturday morning, yelling loudly to make sure that everyone knew he’d arrived. The funny thing was that we had been told by the ultrasound folks to expect a girl.

He’s my first grandchild, and his arrival has been the most wonderful, moving experience. Everything people say about it is true. He also seems to me to be extraordinarily handsome. Note the rakish angle at which he wears his hat. And the way he is already fashionably bored by all the fuss going on around him.