Way back when the enormity of the banking meltdown began to dawn on us, I fell to asking myself: can a country go bankrupt? I meant a normal country — not some basket case like Zimbabwe or Somalia: a country like, well, any member of the EU? It seemed such a naive question, but nobody was asking it. And then, one morning on the Today programme, John Humphreys or one of his colleagues asked it of a very superior academic economist, whose name I forget. He pooh-poohed the idea as absurd; countries don’t go bankrupt, dear boy.

Spool forward to the present. Greece is bankrupt in the technical sense that the government cannot meet its obligations without borrowing from the bond markets and the markets either won’t lend it any more, or will only lend at credit-card rates. The hope is that a loan from Germany (with the implied promise of more to come) will reassure the market to the extent that they will recommence buying Greek government bonds.

Meanwhile, the spotlight has already moved to other EU countries — Portugal and Spain particularly — which the bond market suspects may be heading into the Greek predicament. They, too, will have to be seen to be taking measures to rein in their public debt, otherwise they will find themselves unable to borrow. These measures will probably have to be dramatic, involving chopping some limbs off the welfare state (which is the hallmark of social democracy), and raising taxes.

Now cut to the UK, which is also heavily in debt. Most of us non-economists think that government borrowing is a distant, abstract affair. But actually it’s frighteningly real. The government is ultimately like any business: its revenues have to match its outgoings; if they don’t then it has either to dip into its savings (currently non-existent) or get an overdraft. And last January, a month in which the government is normally awash with cash (because people pay their taxes before on on January 31), the UK Treasury had to borrow money just to get through the month. Scary, ne c’est pas?

Now we’re facing a general election in which all three main parties have put forward plans for reducing the country’s public debt. They agree broadly on what needs to be done: the deficit has to be halved over the life of the next Parliament. The Tories plan to cut £59.2 billion, Labour £47 billion and the Lib Dems £42.7 billion by 2014-15. So far, so good. Each party has set out measures for achieving this goal. The problem is — as the independent Institute for Fiscal Studies pointed out — is that the measures they have spelled out come nowhere near achieving their stated goals.

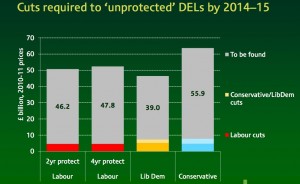

You think I jest? Well, look at this chart from the IFS analysis.

The ‘unspecified’ cuts for each party are the grey areas in this bar chart. The inescapable implication is that none of the parties has specified how the lion’s share of the cuts are to be made. We’re not talking stuff at the margins here: the vast majority of the cuts that the parties say are needed are completely unspecified.

Now spool forward to the day after the election. The new government — of whatever stripe — will have to embark on a programme of implementing the swingeing cuts implied by the grey areas in the chart. Otherwise the bond markets will start getting restive. But the new government will have no mandate for doing this, because they won’t have told the electorate beforehand exactly how the axe will be wielded. When people realise what’s going on they’ll be first stunned and then very, very angry. Rather like the folks currently thronging the streets of Athens, perhaps.

It gets worse. Remember that each party is two of the parties are promising to ‘ring fence’ some cherished public services, like the NHS and schools. That implies that the cuts imposed on ‘unprotected’ services have to be correspondingly more severe — between 18 and 24 percent of annual spending, according to the IFS. Writing in the London Review of Books, John Lanchester meditated on what this might mean.

“At the transport ministry, an 18 per cent reduction would take out more than a third of the department’s grant to Network Rail; a 24 per cent reduction is about equivalent to ending all current and capital expenditure on roads. At the Ministry of Justice an 18 per cent reduction broadly equates to closing all the courts, a 24 per cent cut to shutting two-thirds of all prisons.”

Cuts on this scale are unthinkable. Or are they? My hunch is that they are, because they will endanger social cohesion. So here’s what will happen. There will be a fierce emergency Budget (which is already being prepared by the Treasury) shortly after the election. It will involve savage cuts in all kinds of public services. But because the kinds of cuts that would be required if we were just to rely on them are unthinkable, there will have to be tax rises. Big ones — in income tax, Council Tax and VAT at the very least. Only then will the bond markets be satisfied. No wonder James Carvill (Bill Clinton’s electoral guru) once said that if he were to be re-incarnated he’d like to come back as the bond market, because then he could do exactly as he chose. As Marx might have said: man is born free but is everywhere in hock to the bond markets.

In the meantime, here’s a thought: if I were a political strategist (or David Miliband), I would tell my boss that this would be a great election to lose. Because, as the Governor of the Bank of England is reported to have said, the measures needed to satisfy the bond markets could keep whoever wins the next election “out of power for a whole generation”.