Taken while walking back to my car this afternoon.

Taken while walking back to my car this afternoon.

Nice analysis in the Guardian…

There are four big conclusions.

The first is that the long period of economic expansion that started in September 1992 with the pound’s forced departure from the European exchange rate mechanism is now over. The IMF warned yesterday that Britain’s economy will shrink next year for the first time in 18 years, with a risk that the forecast 0.1% decline in GDP will be over-optimistic. The way things look, that’s a reasonable call.

The second thing to disappear yesterday was the notion that the British economy could survive on finance alone. For the past 20 years, policy-makers in the UK have convinced themselves that the might of the City could compensate for the country’s inability to make anything. The notion that the ever-widening trade deficit was merely a temporary phase while Britain adjusted to a weightless, virtual, financially-driven future has now been exposed for the grotesque fantasy it always was.

Thirdly, the bankruptcy of the City also represents the bankruptcy of New Labour economics, which has been based to an unhealthy degree on a desire to ape the go-getting, deal-making culture of the United States.

Labour governments of the past have always had industrial strategies, which have normally been based on the idea that manufacturing matters. Since 1997, ministers have convinced themselves that Britain had a comparative advantage in financial services and that therefore industrial policy should be based on giving the City what the City wants. The light-touch regulation of financial services was but one expression of the almost total obeisance to big capital.

The manufacturing industry, by contrast, was allowed to wither on the vine, even though the idea that developed western nations can no longer compete industrially with the emerging nations of East Asia is countered by the remarkably good performance of high-cost countries such as Germany and Sweden.

Britain would be a cleaner and more prosperous country if a fraction of the effort spent on making London safe for speculators had been reallocated to harnessing the nation’s raw scientific talent into a thriving environmental technology industry.

Finally, the dominance of the City is over, at least for the time being. What we have seen over the past 14 months is the humbling of the City: what the Greeks would have called nemesis following hubris.

Far from using their freedom from regulation to take wise decisions that would benefit all, banks plunged into investments about which they knew little or nothing. Far from allocating capital in an efficient manner, the credit crunch that has resulted from the orgy of irresponsible lending has led to a dearth of funds for the small businesses that sorely need it.

What we have seen in the first week of October 2008 is a broken-backed industry that promised to be at the cutting edge of the free market, but in reality cannot survive without the largesse of the state.

When it came to it, all the bastions of deregulation – the City, the CBI, the Conservative party – crumbled because they could see the writing on the wall. Without funding from the taxpayer, virtually no bank would be safe from the global financial virus.

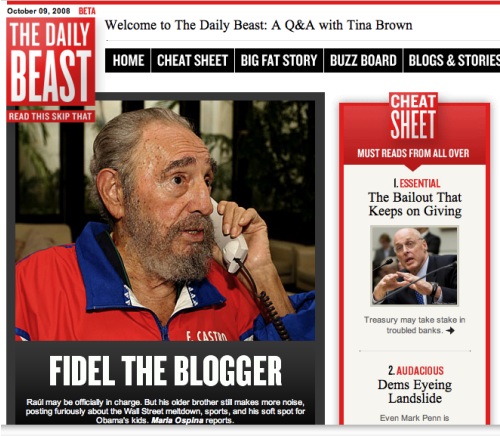

Tina Brown — the editress who nearly trashed the New Yorker — has launched a website which is a contrived nod at the fictional newspaper in Evelyn Waugh’s novel Scoop. She’s clearly aiming at the Huffington Post. My guess is that she’s missed the boat.

Thanks to Gerard for the link.

I’ve always said that if I won the lottery I would do two things: (i) employ my own full-time IT support person; and (ii) take out a subscription to the New Yorker — because then I would have time to read it from cover to cover every week. But last month I decided that life is too short to wait for the lottery (besides, where would I invest the money?), so I signed up for a subscription, and the first issue was waiting for me today when I got home from work. It’s a wonderful magazine, with great writing and liberal, humane values which provides a welcome reminder that there are some great things about America.

One of the more engaging byproducts of the banking crisis.

Cory Doctorow is one of this country’s most valuable immigrants. But, as this scarifying essay reveals, he will be leaving if Brown’s ID Card scheme is implemented.

A few years later, I was living with my partner, and had fathered a British daughter (when I mentioned this to a UK immigration official at Heathrow, he sneeringly called her “half a British citizen”). We were planning a giant family wedding in Toronto when the news came down: the Home Secretary had unilaterally, on 24 hours’ notice, changed the rules for highly skilled migrants to require a university degree…

My partner and I scrambled. We got married. We applied for a spousal visa. A few weeks later, I presented myself in Croydon at the Home Office immigration centre to turn over my biometrics and have a visa glued into my Canadian passport. I got two years’ breathing room. My family could stay in Britain.

Then came last week’s announcement: effective immediately, spousal visa holders (and foreign students) would be issued mandatory, biometric radio-frequency ID papers that we will have to carry at all times. And I started to look over my shoulder…

Now, we immigrants are to be the beta testers for Britain’s sleepwalk into the surveillance society. We will have to carry internal passports and the press will say, “If you don’t like it, you don’t have to live here – it’s unseemly for a guest to complain about the terms of the hospitality.” But this beta test is not intended to stop with immigrants. Government freely admits that immigrants are only the first stage of a universal rollout of mandatory biometric RFID identity cards. What happens to us now will happen to you, next.

Not me, though. If the government of the day when I renew my visa in 2010 requires that I carry these papers as a condition of residence, the Doctorows will again leave their country and find a freer one. My wife – born here, raised here, with family here – is with me. We won’t raise our British daughter in the database nation. It’s not safe.”

I’ve never voted Tory in my life, but next time I will if this proposal isn’t dropped. And so, I hope, will most of the country.

Many thanks to Ray Corrigan for pointing me to Cory’s article, which I’d missed in all the guff about the banking crisis.

Interest comment by David Einhorn, legendary investor…

We wanted to share some thoughts on Microsoft, which we closed during the quarter. We believe that we purchased the shares at an attractive time, and for a good while the investment worked nicely. As has been our habit of late, we overstayed our welcome as the shares peaked after the company announced a very good September 2007 quarter.

Since then, management has acted in an overaggressive and almost panicky fashion regarding its online offering. First, it sought to acquire Yahoo! and then after that failed, it announced extremely high internal investment requirements to pursue this “huge” opportunity (read: “Google-envy”). We doubt the opportunity is what they say it is and wish MSFT focused on its core strength: software.

The CEO is a very smart and very wealthy man. Perhaps, he is so wealthy that he has bigger ideas and aspirations than making MSFT’s shareholders wealthier. We’ve given up on MSFT for now as we feel better investing in companies where management at least appears to be trying to work for shareholders.

It’s deeply satisfying to see the Tory leader excoriating bankers for their obscene bonuses, but there’s something rather embarrassingly closer to home here — as John Gapper points out.

There is no question that professionals of many nationalities – bankers, financiers, estate agents and regulators – behaved badly. They got paid a lot of money and wilfully loosened credit restrictions to keep house prices rising and bonuses flowing. Many of them, although far from all, were American.

But I would like to propose another culprit for the difficulty that many economies are in: you and I. We home buyers and mortgage borrowers share the blame, whether we are American, British or Icelandic.

Take nationality first. A year ago, when the US subprime mortgage debacle was evident but the British housing market was still doing well, I took a trip to London from my home in New York. On a visit to friends in west London, I was struck by the number of houses in their street with “To Let” boards outside.

At the time, there was a lot of talk about how the UK housing market differed from that of the US because it was a small island with a limited housing stock, there was no equivalent of subprime lending and so on. But those “To Let” boards said something different to me.

They showed that cheap debt and rising asset prices had led to housing speculation all over the world; it just took different forms. In wide, flat Florida it created sprawls of condominium apartments; in densely packed UK cities it generated a rush into buy-to-let properties. For subprime mortgages in the US, read “self-certified” UK loans…

I’m a conservative about money and so have been watching what’s been going on for the last decade with mounting disbelief — in this country and in Ireland. The Buy-to-Let racket in the UK was particularly screwy. There was a time, for example, when owners of such properties weren’t particularly bothered if they didn’t have tenants because their value was escalating so quickly that the rent was just icing on the cake. One didn’t need to be a rocket scientist to realise that this was nuts.

… in 1967, Che Guevara was executed in Bolivia while attempting to incite revolution there.