Terrific post by Dave Winer.

Flash back to the United Nations on 2/5/03. An impressive almost Presidential Secretary of State, Colin Powell, delivering some chilling news, not coming right out and saying it, but definitely leading you to believe that Saddam has nukes and chemical weapons and stuff even more horrible and is getting ready to use all of it in some unspecified horrible way. It’s the lack of specificity that makes it so chilling.

Consider the whole scenario. Powell can’t tell us what the danger is because that would violate some security that he can’t violate. Well, I did what a lot of Americans did that day, I sucked it up and got behind my government. And they suckered me. And I’ll never forget it. I got fooled, and used, and a lot of people died, in the name of freedom, and it was all a lie.

We all paid a huge price that day, and the bill may be coming due today, because they’re presenting us with the same scenario, this time about the economy. And we’re not going for it. You can see it in the way things flipped around overnight. A lot of people woke up this morning, like I did, and realized — wait I’ve seen this movie before.

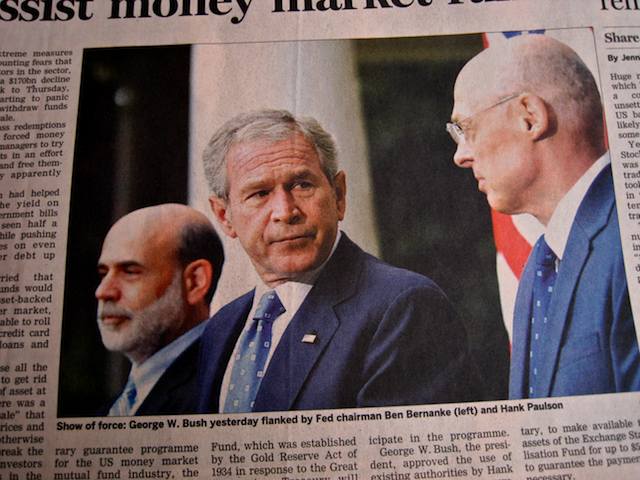

Now we have another impressive Almost Presidential secretary, Henry Paulson, who says there’s impending doom, but he can’t say exactly what it is, it’s not security this time, but fear of starting another level of bank runs. Senators and Representatives come out of a Thursday night meeting with the secretary (would they have believed the President) won’t say exactly what he said, but they are stunned. The next day buried in a sea of press about this event is an almost innocuous paragraph in a NYT piece that talks about a flight to safety from the US Treasury money market. OMG. A point made by the secretary to the Congresspeople, a lot of your constituents have their savings in money markets. The Senators think to themselves, Fuck the constituents, that’s where my retirement savings are! (And by the way, mine.)

And who elected Hank Paulson btw? Dave’s point is that

we can’t do it on the terms that Paulson asks for. There has to be some pain and there has to be oversight and checks and balances. There’s no such thing as a law passed by Congress that can’t be judged by the courts. Not in the USA, not under our form of government. And no way is Bush going to get that by us.

So here’s what I propose. The Republican slogan today is Country First. So let’s see the Republicans do a little of that famous Country First stuff.

Bush and Cheney must resign immediately. No immunity, no pardons. Nancy Pelosi will become President, promising not to run for re-election on November 4. Her term will be one of the shortest in US history, just long enough to enact the provisions of the bill being proposed by the Republican administration. If it really is the best thing for the country and not a trick, then the Republicans, being impressed by the seriousness of it, would have to insist that Bush step aside and let the Democrats execute the plan. The entire Bush cabinet stays in office through January 20, but reports, of course to Pelosi. And that includes Paulson.

It’s pretty simple. If they won’t do it, we know they’re bluffing.

Hmmm…. I think we know the answer to that one.

James Miller pointed me to an interesting post by Robert Reich, the Harvard academic who was Bill Clinton’s Secretary of Labor for a while:

The public doesn’t like a blank check. They think this whole bailout idea is nuts. They see fat cats on Wall Street who have raked in zillions for years, now extorting in effect $2,000 to $5,000 from every American family to make up for their own nonfeasance, malfeasance, greed, and just plain stupidity. Wall Street’s request for a blank check comes at the same time most of the public is worried about their jobs and declining wages, and having enough money to pay for gas and food and health insurance, meet their car payments and mortgage payments, and save for their retirement and childrens’ college education. And so the public is asking: Why should Wall Street get bailed out by me when I’m getting screwed?

So if you are a member of Congress, you just might be in a position to demand from Wall Street certain conditions in return for the blank check…

He goes on to set out five conditions. The one I like best is that banking bonuses be based on a five-year rolling average of performance.