Michael’s got some new kit — including an amazing keyboard.

Daily Archives: November 8, 2007

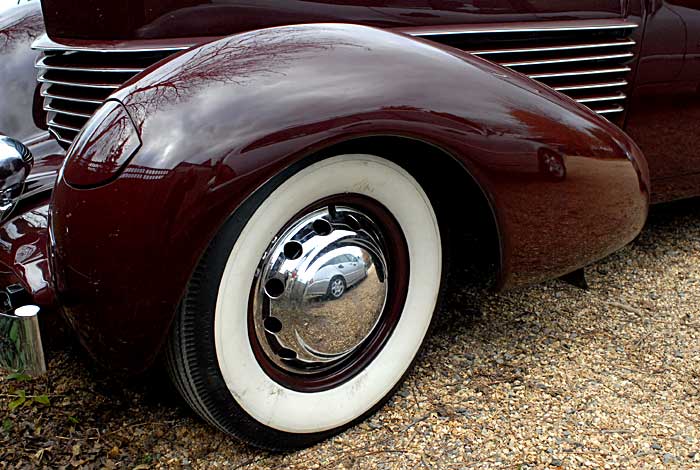

Wheels within wheels

Ah, white-wall tyres. They were all the rage in 1940s America. They don’t make ’em like this any more. Sigh.

Observed in a gastro-pub’s car park.

Memento mori

Remember the Antonioni film? Well, driving through town this morning I came on this perfectly ordinary house.

Now, here’s a blow-up of that upstairs window.

Interesting, ne c’est pas?

Money for jam

From a Telegraph report

Tony Blair has come under fire in the Chinese media for charging nearly £200,000 for a single speech – and not a good one at that.

The former prime minister spoke to businessmen and government officials in the industrial city of Dongguan, two hours’ north of Hong Kong, on Tuesday evening.

Local media estimates of his fee ranged from US$330,000 to US$500,000 (£160,000 to £240,000).

Although the real estate firm which hired him for a “VIP banquet” refused to confirm the sum, the local tax office admitted he had paid just under £80,000 in income tax and £6,500 for a three per cent business tax, which would work out to a total fee of about just under £200,000.

What made matters worse for newspaper commentators was that Mr Blair failed to say anything interesting.

One said he had trotted out the same platitudes about the importance of collaboration between government and business, and of the environment, as you would hear from the officials in his audience.

“Frankly, we are very familiar with all this – it’s just like listening to any county or city official’s reports,” Deng Qingbo wrote in the China Youth Daily…

The piece goes on to say that a recent US tour netted £300,000 for the disgraced former PM.

SIVs explained

Puzzled about the subprime market crisis? Try this explanation by John Bird and John Fortune.

Excerpt:

Fortune: How does that [the subprime market] work?

John Bird: Well, imagine if you can an unemployed black man sitting on a crumbling porch somewhere in Alabama in a string vest and a chap comes along and says “would you like to buy this house before it falls down? and “why don’t you let me lend you the money?”

JF: And is this chap who says this, is he a banker?

JB: Oh no, no, he’s a mortgage salesman. His income depends entirely on the number of mortgages that he can arrange.

JF: So, his judgement to arrange mortgages is completely objective?

JB: Completely objective, yes.

JF: And what happens next?

JB: Well, this debt, this mortgage, is taken — bought — by a bank and packaged together on Wall Street with a lot of other similar debts…

JF: Without going into much detail about what is actually…

JB: Without going in to any detail. No, it’s far too boring. And so this is put into a package of debt and then it’s moved onto Wall Street and … it’s extraordinary what happens then… somehow this package of dodgy debts stops being a package of dodgy debts and starts being what we call a Structured Investment Vehicle…

Bird and Fortune are comic genuises. No other words for it. I’d missed the South Bank Show on which they appeared, so thanks to Hap for reminding me.

Fixed!

I hate zoom lenses, partly because of the optical compromises implicit in zooming, and partly because they introduce an unnecessary variable in composition. But most DSLRs seem to come with zoom lenses only. I’ve been using an old 50mm lens on my D200 and it’s worked very well but because of the fudge factor (1.5) needed to allow for the difference between the size of the sensor compared with 35mm film, it winds up being the equivalent of a focal length of 75mm. So the other day, courtesy of ffordes, I found a good used 28mm f2.8 Nikkor (which is the equivalent of about 42mm) and it’s just perfect.