Lovely spoof, based on my favourite movie.

Category Archives: Politics

Going Dark? Dream on.

This morning’s Observer column:

The Apple v FBI standoff continues to generate more heat than light, with both sides putting their case to “the court of public opinion” — which, in this case, is at best premature and at worst daft. Apple has just responded to the court injunction obliging it to help the government unlock the iPhone used by one of the San Bernadino killers with a barrage of legal arguments involving the first and fifth amendments to the US constitution. Because the law in the case is unclear (there seems to be only one recent plausible precedent and that dates from 1977), I can see the argument going all the way to the supreme court. Which is where it properly belongs, because what is at issue is a really big question: how much encryption should private companies (and individuals) be allowed to deploy in a networked world?

In the meantime, we are left with posturing by the two camps, both of which are being selective with the actualité, as Alan Clark might have said…

Brexit, 1997-style

This video was, I think, sent to every household in the UK in 1997. It will still resonate with some voters on June 23, I suspect.

Quote of the Day

“This case is like a crazy-hard law school exam hypothetical in which a professor gives students an unanswerable problem just to see how they do.”

Law Professor Orin Kerr, in a thoughtful and informative article on the dispute between Apple and the FBI over the San Bernardino killer’s iPhone 5.

Economic populism: or one reason why Trump and Sanders are thriving

Nice New Yorker piece by James Surowiecki:

Both Trump and Sanders downplay the enormous economic benefits of globalization for American consumers of all incomes, and their proposed solutions are vague and could well be harmful if implemented. But their words resonate with many voters, because they articulate an important truth: free trade has created major winners and major losers in the U.S. economy, and the losers—mostly blue-collar workers—have received little or no help. Trade with China, in particular, has inflicted serious damage on American communities across the country, damage from which they have yet to recover. As the economists David Autor, David Dorn, and Gordon Hanson have documented1, what they call the “China shock”—beginning in 1991 and lasting into this century—demolished manufacturing in much of the U.S. Workers in the affected communities had a hard time finding and keeping new jobs, and unemployment stayed high and wages low for at least a decade afterward.

Trade isn’t the only reason that blue-collar workers’ standard of living has declined; automation and weaker unions have also played a part. By focussing on trade, though, both candidates are acknowledging something important: what has happened to U.S. labor was not a natural disaster but, in part, the product of government policies designed to accelerate globalization and expose American workers to foreign competition. That admission is more than working-class Americans have got from most Presidential candidates.

-

The abstract for their NBER paper “The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade” reads:

“China’s emergence as a great economic power has induced an epochal shift in patterns of world trade. Simultaneously, it has challenged much of the received empirical wisdom about how labor markets adjust to trade shocks. Alongside the heralded consumer benefits of expanded trade are substantial adjustment costs and distributional consequences. These impacts are most visible in the local labor markets in which the industries exposed to foreign competition are concentrated. Adjustment in local labor markets is remarkably slow, with wages and labor-force participation rates remaining depressed and unemployment rates remaining elevated for at least a full decade after the China trade shock commences. Exposed workers experience greater job churning and reduced lifetime income. At the national level, employment has fallen in U.S. industries more exposed to import competition, as expected, but offsetting employment gains in other industries have yet to materialize. Better understanding when and where trade is costly, and how and why it may be beneficial, are key items on the research agenda for trade and labor economists.” ↩

What the FBI vs Apple contest is really about

Wired nails it

But this isn’t about unlocking a phone; rather, it’s about ordering Apple to create a new software tool to eliminate specific security protections the company built into its phone software to protect customer data. Opponents of the court’s decision say this is no different than the controversial backdoor the FBI has been trying to force Apple and other companies to build into their software—except in this case, it’s an after-market backdoor to be used selectively on phones the government is investigating.

The stakes in the case are high because it draws a target on Apple and other companies embroiled in the ongoing encryption/backdoor debate that has been swirling in Silicon Valley and on Capitol Hill for the last two years. Briefly, the government wants a way to access data on gadgets, even when those devices use secure encryption to keep it private.

Yep. This is backdoor so by another route. It’s also forcing a company to do work for the government that, in this case, the government wants to do but claims it can’t. This will play big in China, Russia, Bahrain, Iran and other places too sinister to mention.

The FBI’s argument that the phone is vital for its investigation Seems weak. They already know everything they need to know, and the idea that the San Bernardino killers were serious ISIS stooges seems the prevalence of mass shootings in the US, and the say they conformed to type. What’s more likely is that the agency is playing politics. They’ve been arguing for yonks that they simply must have back doors. The San Bernardino killers presented them with a heaven-sent opportunity to leverage public outrage to force a tech company into conceding the backdoor principle.

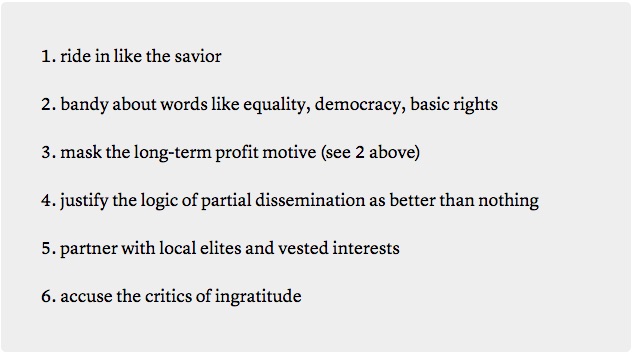

Neo-colonialism, Facebook style

Quote from Deepika Bahri, an English professor at Emory University who focuses on postcolonial studies, in a terrific article about Facebook’s failed campaign to have Free Basics accepted in India.

Bernie Sanders’s new campaign ad

Quote of the Day (indeed of the year)

“What people want… is not facts so much as answers to questions which will always be disputed because they are not only unknown but unknowable.”

Lord Ashcroft, writing about the EU Referendum.

The real impact of falling oil prices

Interesting take on it by Harold James from Princeton.

Oil seems to be going the way of timber and steel, losing its strategic importance. Large amounts of energy will still be needed for the basics of modern life, including data processing and storage, but it will increasingly come from other sources.

This is likely to have epochal consequences, as weakening oil prices undermine the authoritarian regimes that control the main producers. There is a large amount of scholarly evidence linking dependence on natural resources with poor governance – the “resource curse.” Whatever the many differences among Nigeria, Venezuela, Saudi Arabia, Russia, Iran, and Iraq, all have one thing in common: Oil revenues have corrupted the political system, turning it into a deadly struggle for the spoils. As prices fall, the bandits in charge will quarrel more among themselves – and with their neighbors.

The leaders of oil-producing countries are already busy concocting narratives explaining their country’s misfortunes. Venezuela’s President Nicolás Maduro has taken up the Latin American left’s old, populist slogans and pointed his finger at the US. Similarly, Russian officials are drawing parallels between today’s events and the falling oil prices that undermined the Soviet Union. In both cases, the US is to blame; hydraulic fracturing in Oklahoma or Pennsylvania, according to this narrative, is the latest example of America’s projection of power abroad.

In other words, the security challenges implied by dropping oil prices are likely to be more significant than the economic risks…