Interesting stuff from Wikileaks.

In the beginning was the command line…

Interesting personal ad on Craigslist.

There is a sad truth to the world today. I am part of a dying breed of people known as “shell users.” We are an old-fashioned bunch, preferring the warm glow of a green screen full of text over the cold blockiness of a graphical interface. We use ssh, scp, and even occassionally ftp. Back in the days before high-speed connections (“broadband”), we would dial up during off-hours to avoid being slammed with huge phone bills. The whole “Microsoft Windows” fad will fade away sooner or later, but in the interim, our kind is facing extinction.

Because there are fewer and fewer of us, I must help keep our lineage alive. I am looking for someone to help me do this. I need a woman (obviously) who is willing to raise a child with me in the method of Unix. Our child will be introduced to computers at a young age, and will be setting emacs mode before any other child can even read. I earn a sufficient income to support a family in modest comfort. Other than the fact our child will be bright, text-based and sarcastic, we will otherwise be a normal family. We will even go to Disney World and see Mickey Mouse.

So, if you are a woman between the ages of 23 and 43 who is ready to raise a child in the way of the shell, let me know so we can begin the process. (If you are ready to raise more than one child, even better.)

The Diana inquest

Max Hastings says:

The inquest into the death of Princess Diana is providing a circus for the prurient, a dirty-raincoat show for the world, of a kind that makes many of us reach for a waxed bag.

Day after day for almost three months, a procession of charlatans, spivs, fantasists, retired policemen, royal hangers-on and servants who make Iago seem a model of loyalty has occupied the witness box at the law courts in the Strand. They have itemised the princess’s alleged lovers, her supposed opinions of the royal family (and vice versa), her contraceptive practices and her menstrual cycle…

Readers who have laid in a goodly supply of waxed bags may read the daily transcripts here.

Republican make-believe

Great column today by Gary Yonge on the US presidential election. He’s especially good about Republican supporters.

Having warped their understanding of how the world works to suit their ideology, they now have the terrible burden of having to live in it. On the whole, these are personally affable and politically angry people. The targets of their rage are clear: Hillary Clinton, the liberal media, illegal immigrants, Muslims, taxes, the government and nationalised healthcare all take their turns in the crosshairs.

But the source of their rage is a mystery. In George Bush, Conservatives have had almost everything they wanted. Tax cuts, war and conservative supreme court justices have all been forthcoming. For much of the time he has been in the White House the Republicans have controlled both houses of Congress too. To the faithful, that the economy is nosediving, the war has been judged a failure and the president’s approval ratings scrape historic lows are tiresome details. Since they only have themselves to blame, they simply change the subject and hope no one will notice.

When Republican presidential hopeful Mitt Romney declares “Washington is broken” before a cheering crowd in Bluffton, you have to wonder who they think broke it. Romney went on to say, with a straight face, that he drew his inspiration from “Ronald Reagan, George Herbert Walker Bush, Nancy Reagan and Barbara Bush”. When a leading presidential contender says he is enthused by the president’s mother but won’t mention the president himself, it becomes clear to what extent those who wish to be head of state must first occupy a state of denial…

Linux sub-notebooks finally arrive

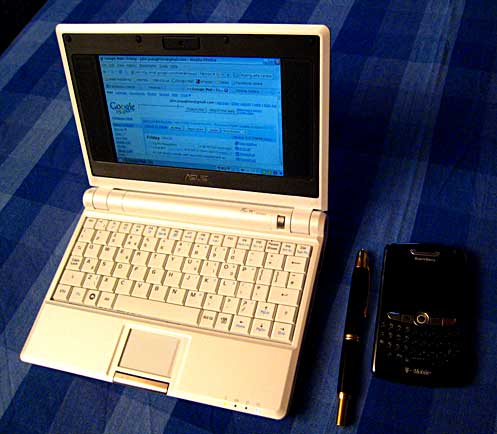

This is the ASUS Eee 701 PC. Acting on the suggestion of a colleague, just before Christmas I slipped into a Toys ‘R Us store, handed over £219 (£186.38 ex VAT) and came home with a smartest little machine I’ve seen in ages. It’s a Linux box configured for the school-kid market (hence the retailer — Research Machines are also selling it to educational institutions), and it’s been a revelation. First of all, it’s really small and portable (0.89kg and not much bigger than a paperback book), but has a usable keyboard, good on-board applications and built-in wireless networking. It’s also an object lesson in how to package Linux for non-techies. Here are the apps, for example:

It comes with FireFox and OpenOffice pre-configured. And the webmail option comes with Google, Yahoo and Hotmail icons all ready to go. Likewise icons for Skype, a Messenger client, Google Docs and Wikipedia. It’s powered by an Intel M 900 MHz processor, has 512 MB of RAM plus 4GB of flash disk, and takes USB drives and an SD card. It also has an 0.3 megapixel onboard camera (plus some apps for using it), a VGA port (for an external monitor) and an Ethernet port as well as microphone and headphone sockets. And all for £186 + VAT.

Having a genuinely small and unobtrusive networking device around is interesting. When I’m home, I tend to have my Mac laptop tethered to a big screen and audio set-up in the study, so find myself carrying the ASUS round the house, using it to read mail or browse BBC News when cooking, or for cheating when we’re doing crosswords at the dining-room table! The 7″ screen is a bit small for some purposes, but in the main it’s perfectly readable.

The only downsides I’ve discovered so far are:

There’s also a model running a version of Windows XP — though in that case you’re paying more (£299) for a crash-prone system. There’s one masochist born every second. Or is it every minute?

Update: Most of the reviews I’ve found are pretty perfunctory, but this CNET one is informative. There are also some informative videos — notably this IDG News Service preview.

And this:

As you’d expect, lots of people are hacking this neat little machine. Here’s how to turn it into a touchscreen device. Here are some useful tips if you want to poke around in the innards. Some people have replaced the Xandros Linux distribution with Ubuntu. And there are even claims that people have installed Mac OS X on the ASUS.

Question of the day

Which leading US presidential candidate believes that ancient Israelites migrated to America before Columbus, where they were – get this – visited by Jesus Christ?

Answer, according to Damien Thompson is Mitt Romney, who is a Mormon, though not, I believe, a practising polygamist.

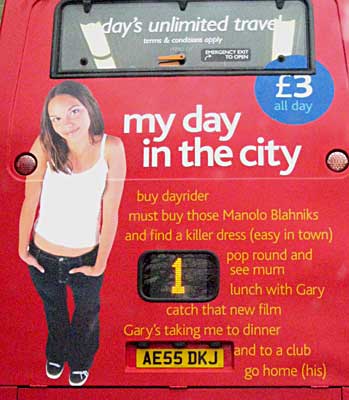

All in a day’s work

One of the more irritating sides of living in Cambridge is the idiotic ads that appear on the buses. Here’s a classic example of aspirational inanity. Odd to think that someone gets paid for writing this garbage.

The joys of reading. Or perhaps not…

Observed in a bookshop.

Tulip mania

But at least there’s no financial downside to my addiction to these beautiful flowers.

Rich pickings under Labour

From The Observer this morning…

The rich have prospered under New Labour, and the top 10 per cent of adults now take home 40 per cent of the all the income earned in Britain, according to new analysis by the authoritative Institute for Fiscal Studies.

Despite a battery of redistributive policies enacted by Gordon Brown in his decade as Chancellor to boost the incomes of the poorest in society, the bumper sums earned in the City as the equity markets boomed have helped to keep those at the top moving ahead…

Hmm… I bet they will do even better under Cameron.