What’s in a picture?

From Noema:

Where a host meets his guests reveals the context in which he wants to be regarded. The background decor of the chosen setting is more than a telling detail. It is the writing on the wall.

In the case of Russian President Vladimir Putin and Chinese President Xi Jinping, the image of power they want to project is out of the historical realm of czars and emperors among whom they place themselves. The civilizational past portrayed on their walls suffuses their vision of the future. It is the common springboard of opposition to the liberal world order of the West they are united in resisting.

This was in splendid evidence at the Moscow summit this week when Putin hosted a banquet for Xi at the 15th-century Palace of Facets in the Kremlin where czars celebrated after their coronation and consecrated the top clergy of the Orthodox Church. The mural behind the two leaders in the photo above, which depicts Vladimir the Great and his sons, is meant to convey legitimacy conferred through continuity. Vladimir ruled what came to be called the Kievan Rus from 980 to 1015, when he unified disparate principalities into one state and converted the nation to Christianity.

It is this very history that lay behind Putin’s justification of the invasion of Ukraine. Could he have been more explicit in what he was asking Xi to endorse?

The Chinese leader may have been unaware of the message the wily namesake of Vladimir I was sending through a staged photo-op. But he would have easily understood the uses of historical continuity as a touchstone to legitimate his own rule.

If Xi was unaware of it at the time, he isn’t now. Besides, as Noema points out, he uses similar imagery himself from time to time.

Quote of the Day

“You only live once, but if you do it right, once is enough”

- Mae West

Amen.

Musical alternative to the morning’s radio news

The Dubliners | Christ Church

Long Read of the Day

On the allurements of conspiracy theory

Really astute and insightful essay by Phil Christman in the Hedgehog Review on a subject that my colleagues and I spent some years studying before it was academically fashionable. Interesting for — among other things — the way it tries to get inside a conspiracist’s head.

One day, you stumble across something—a long video, an article, a conversation (How rare those are! You must make more time for them…) with a learned friend. The same self-righteousness of authority crosses his face, the tinniness of certainty issued from his mouth too, but this time what he says sticks. It seems to explain the wrongness. Or not even explain it, really—just make it stand still. It was this thing that was wrong. The monster disclosed himself. He was something small and definable—a vaccine, a chemical—that spreads until it can’t be isolated, or he was something large and indefinable—“wokeness,” “CRT”—that terminates in many small, sharp wrongnesses. Or maybe it was the second sort of thing, but epitomized in a single image, so that it sounds like the first: The Cathedral. The cabal. But for a second, you could see the wrongness. How clarifying, simply to see it. You felt something like desire.

As you read on, as you watch more videos, as you continue to talk with your learned friend, you experience, for perhaps the first time in your life, the joy of scholarship. What was school, anyway? A punishment for being awake, a reminder that for every minute of playground, life will exact an hour of sitting still in a hot room that stinks of others’ lunches digesting. How can one doubt the existence of malign conspiracies in a world that answers the miraculous sharpening of adolescent senses with the sense-insulting colors, shapes, smells, of school? School never gave you this feeling, the feeling that “there is a world inside the world,” as Don DeLillo writes in Libra (1988), his great novel of the John F. Kennedy assassination. You start to become, as DeLillo depicts Oswald becoming, a sort of secular monk…

You read like Oswald, obsessively. You marshal for yourself the rough narrative of history that education should already have given you. You become that precious and imperiled thing, an autodidact…

It’s long but worth it.

Gordon Moore RIP

A great figure from the history of modern computing has passed away. Gordon Moore was a co-founder of Intel and the inspiration for the eponymous ‘Law’ predicting that the number of transistors that could be placed on a silicon chip would double at regular intervals for the foreseeable future, thus increasing the data-processing power of computers exponentially.

Holcomb Noble and Katie Hafner have a nice Obituary of him in the New York Times.

I met him once. He was on a visit to Cambridge, where he had endowed a beautiful science and technology library. I asked for an interview and we met in the office of the University Librarian and had a long chat about the early history of the industry and the part he had played in it. At one point I noticed that he was still wearing the ancient digital watch for which he had become famous and asked him why he still wore it. He answered that it was a peg for one of his stories — namely that, at $15 million it was the most expensive watch in the world. How come? Because that was Intel lost from trying to get into — and exiting from — the digital watch business.

Our talk was very enjoyable but after a while I started to worry about his schedule and mentioned to him that the car that the University had arranged to take him to meet the then Chancellor of the University (Prince Philip) should now be picking him up. So we went down to the Library entrance and… there was no limo in sight. He didn’t have a contact number for someone to call, but he knew where he was supposed to be heading. So we climbed into my battered Saab — littered with kids’ toys, tennis racquets and other junk — and I drove him to his destination.

After I dropped him off I drove home and told my late wife Sue about the about my role as an impromptu chauffeur. She was not amused. “What!” she expostulated. “You drove Gordon Moore in our crummy jalopy.” Then she went to her laptop, ascertained how many Intel shares Moore then owned, multiplied that by the share price and came back with the number $7B. The least I could have done, she said, was to get him to buy us a new Saab.

He was a nice and a good man. May he rest in peace.

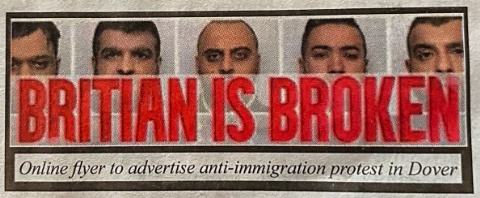

You wait ages for an AI chatbot to come along, then a whole bunch turn up. Why?

Yesterday’s Observer column:

When, late last year, the editor asked me and other Observer writers what we thought 2023 would be like, my response was that it would be more like 1993 than any other year in recent history. Why? Simply this: 1993 was the year that Mosaic, the first modern web browser, launched and all of a sudden the non-technical world understood what this strange “internet” thing was for. This was despite the fact that the network had been switched on a whole decade earlier, during which time the world seemed almost entirely unaware of it; as a species, we seem to be slow on the uptake.

Much the same would happen in 2023, I thought, with ChatGPT. Machine-learning technology, misleadingly rebranded as artificial intelligence (AI), has been around for eons, but for the most part, only geeks were interested in it. And then out comes ChatGPT and suddenly “meatspace” (internet pioneer John Perry Barlow’s derisive term for the non-techie world) wakes up and exclaims: “So that’s what this AI stuff is all about. Wow!”

And then all hell breaks loose, because it turns out that all the tech giants, who had been obsessed with this generative AI stuff for years, realised that they had been scooped by a small US research outfit called OpenAI (cunningly funded by boring old Microsoft)…

My Commonplace Booklet

The other day, I wondered what a “hammered dulcimer” might be. (I was vaguely reminded of my undergraduate days when the term “hammered” described someone so drunk as to be incapable of independent locomotion, and I was entertaining fantasies of a inebriated musical instrument wandering the streets.)

Sheila Hayman (Whom God Preserve), whose mission in life is to protect me from my invincible ignorance, provided rapid enlightenment.

Basically, before pianos, keyboard instruments (harpsichords, clavichords, dulcimers) made their notes by plucking the strings, which meant no gradations of sound, no resonance, no long or short notes. Dual keyboard harpsichords made it possible to do loud or soft, but nothing in between. Then forte pianos and later pianofortes came along which hit the strings with hammers, which could be done more or less hard, giving more range of sound. Then dampers and the ‘loud’ pedal gave us resonance, and the ‘soft’ pedal (which just shifts the hammers along so they only hit two strings rather than three) gave an extra layer of expressiveness. Then Erard invetned the double escapement action which made it possible to repeat notes very quickly. Then Beethoven came along and showed what could be done with it. As did Fanny [Mendelssohn] about whom Sheila has made a new documentary.

So a hammered dulcimer, as I understand it, is an evolved dulcimer in which the strings are hammered, not plucked.

So now I know. And so , dear reader, do you.

This Blog is also available as a daily email. If you think that might suit you better, why not subscribe? One email a day, Monday through Friday, delivered to your inbox. It’s free, and you can always unsubscribe if you conclude your inbox is full enough already!