Levelling the playing field

This morning’s Observer column:

Whenever regulators gather to discuss market failures, the cliche “level playing field” eventually surfaces. When regulators finally get around to thinking about what happens in the online world, especially in the area of personal data, then they will have to come to terms with the fact that the playing field is not just tilted in favour of the online giants, but is as vertical as that rockface in Yosemite that two Americans have finally managed to free climb.

The mechanism for rotating the playing field is our old friend, the terms and conditions agreement, usually called the “end user licence agreement” (EULA) in cyberspace. This invariably consists of three coats of prime legal verbiage distributed over 32 pages, which basically comes down to this: “If you want to do business with us, then you will do it entirely on our terms; click here to agree, otherwise go screw yourself. Oh, and by the way, all of your personal data revealed in your interactions with us belongs to us.”

The strange thing is that this formula applies regardless of whether you are actually trying to purchase something from the author of the EULA or merely trying to avail yourself of its “free” services.

When the history of this period comes to be written, our great-grandchildren will marvel at the fact that billions of apparently sane individuals passively accepted this grotesquely asymmetrical deal. (They may also wonder why our governments have shown so little interest in the matter.)…

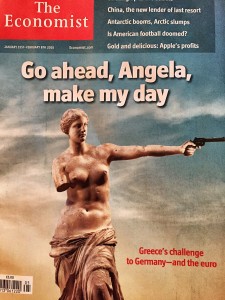

Make my day

Quote of the Day

“Advice is what we ask for when we know the answer but wish we didn’t.”

Erica Jong

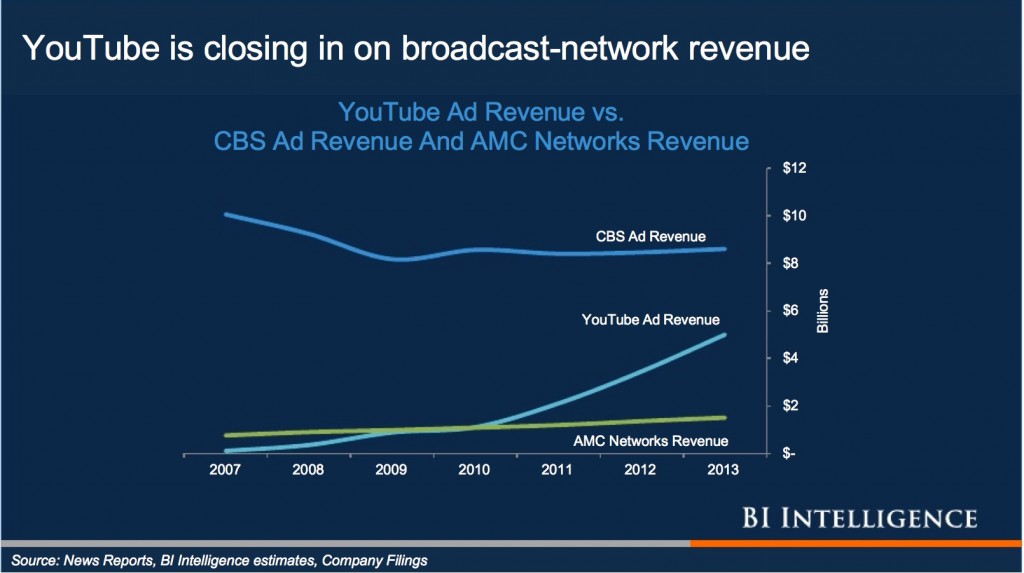

So should it be called Apple Phone Inc?

Once upon a time, Apple was called Apple Computer Inc. This was partly because the Beatles had a lock on ‘Apple’, but it was also an honest description of the company.

But now? Well, the company still makes computers. (Some very nice ones too.) But consider this:

In the period that ended Dec. 27, Apple sold $51.2 billion worth of iPhones. Those sales comprised nearly 69 percent of the company’s total sales for the quarter — a record portion by a long shot. Indeed, Apple was so successful at selling iPhones during its first fiscal quarter that if it had sold nothing else — no iPads, no Macs, nothing — its total sales would still have been the third highest it had ever recorded.

The commentariat is busy opining that there are dangers in being a one-trick pony — which if course there are. Still, it’s one hell of a pony.

Medium is its own message

“Rather than casting our writing into the open maelstrom of the internet, Medium provides a sheltered space where writers don’t have to compete with other forms of content. Here, the written word rules, and everyone is an eager reader. If the internet is a city, Medium is a village.”

From an interesting essay by Marius Masalar reflecting on Medium as a publishing platform for writers and bloggers.

Do not try this

A fragment of the Yosemite climb. Unbelievable.

So what really lay behind Syriza’s victory?

Paul Mason has a hunch:

Syriza’s economics people have been crystal clear: they will no longer deal with the Troika (the EU/ECB/IMF body that runs the austerity programme). They will deal as a sovereign country with each institution separately. They argue the Troika itself was illegal.

So there is a real possibility that, as Tsipras annuls austerity this week, the hawks in the ECB – centred on Germany – will threaten to pull the Emergency Lending Assistance that keeps Greek banks afloat.

Right now Syriza’s economics team are trying to mobilise political support to stop this – from Francois Hollande, Matteo Renzi and, I am told, George Osborne. We’ll see.

For now make no mistake: this is going to become about sovereignty and democracy and the soul of the Eurozone.

Yes the Syriza people like to sing the Italian left anthem Bandiera Rossa; but if you could see the young people’s faces as they sing the anthem of ELAS, the resistance movement that defeated the Wehrmacht in 1944, you would understand what drives leftism here.

Note that last paragraph.

A Greek bearing not gifts, but common sense

Today programme interview with Yanis Varoufakis

Most interviews with politicians on BBC Radio 4’s Today programme are irritating. But not this one — with Syriza’s Yanis Varoufakis, an economist who has just been elected to parliament on the Syriza ticket and may well be the country’s next Finance Minister. Worth hearing in full.

So what’s driving the deficit reduction mania?

I’m not a conspiracy theorist, but…

Neither is Simon Wren-Lewis, the Oxford economist. But consider this interesting post on his blog:

I have searched hard to find a macroeconomic rationale for Osborne’s policy stance. A belief that QE is as effective as conventional monetary policy (there is no liquidity trap) comes close, but as I explained here it does not really fit with what Osborne has said (or not said). Osborne is certainly no market monetarist, as he has shown no interest in nominal GDP targeting. So there does not appear to be a coherent case for Osborne’s fiscal proposals that a macroeconomist could take seriously.

Second, the idea that the real motive is a small state is not the preserve of some small group of left wing conspiracy theorists. Here I quote Jeremy Warner, economics editor of the Telegraph (for non-UK readers, a newspaper firmly to the right): “In the end, you are either a big-state person, or a small-state person, and what big-state people hate about austerity is that its primary purpose is to shrink the size of government spending.” He also wrote: “The bottom line is that you can only really make serious inroads into the size of the state during an economic crisis. This may be pro-cyclical, but there is never any appetite for it in the good times; it can only be done in the bad.” I also think many of my non-UK readers will wonder why I am having to justify what is obvious in their countries.

Third, it must have become clear to many people now that reducing the deficit cannot be the overriding priority when there have been so many tax giveaways (50p rate, Help to Buy which creates large contingent liabilities, Cameron’s conference commitments, stamp duty changes that are far from fiscally neutral, pensioner bonds). Putting these down to ‘politics’, but counting spending cuts as ‘economics’, will not wash. (See Brad DeLong for the equivalent in the US). You cannot pretend that deficit reduction is driving government policy, when that driver only operates on the spending side of the accounts.

Economists in the media are beginning to realise this. It is really important that political commentators do so as well, so that those without an economics background get a clearer idea of the nature of the choices they will have to make in 100 days time.

Of course, it’s also conceivable that Osborne & Co don’t really know what they’re doing. It’s been known to happen with British governments.

And then, later this from Joseph Stiglitz:

For the past six years, the West has believed that monetary policy can save the day. The crisis led to huge budget deficits and rising debt, and the need for deleveraging, the thinking goes, means that fiscal policy must be shunted aside.

The problem is that low interest rates will not motivate firms to invest if there is no demand for their products. Nor will low rates inspire individuals to borrow to consume if they are anxious about their future (which they should be). What monetary policy can do is create asset-price bubbles. It might even prop up the price of government bonds in Europe, thereby forestalling a sovereign-debt crisis. But it is important to be clear: the likelihood that loose monetary policies will restore global prosperity is nil.

This brings us back to politics and policies. Demand is what the world needs most. The private sector – even with the generous support of monetary authorities – will not supply it. But fiscal policy can. We have an ample choice of public investments that would yield high returns – far higher than the real cost of capital – and that would strengthen the balance sheets of the countries undertaking them.

The big problem facing the world in 2015 is not economic. We know how to escape our current malaise. The problem is our stupid politics.

Bill Clinton was famous for his mantra “It’s the economy, stoopid”. The mantra we need now is “It’s the politics, stoopid”.