Seen in a street in Liverpool.

Online crime, USA

These numbers look like huge under-estimates to me. The obvious interpretation is that much online crime is never reported to the FBI. Interesting though that women fall for fake romance scams, while men lose their marbles over automobiles.

How to start a piece

Louis Menand is, IMHO, the best living literary critic. Perhaps that’s because he’s the most readable. At any rate, I will read anything he writes, on any subject.

One of his gifts is that, like Hemingway, he lures the reader in at the very beginning. Here he is doing it in a recent New Yorker essay on Saul Bellow:

Herzog is the book that made Saul Bellow famous. He was forty-nine years old when it came out, in 1964. He had enjoyed critical esteem since the publication of his first novel, “Dangling Man,” in 1944, and he had won a National Book Award for “The Adventures of Augie March” in 1954. But “Herzog” turned him into a public figure, a writer of books known even to people who don’t read books—an “author.” At a ceremony honoring the success of “Herzog” at city hall in Chicago, Bellow’s home town, a reporter asked the mayor, Richard J. Daley, whether he’d read the novel. “I’ve looked into it,” Daley said.

You get enough people saying that and you have a best-seller…

See what I mean? Read on.

Fame at last!

Many thanks to the numerous people who wrote to tell me that Maureen Dowd had mentioned me in her splendid column about Uber. She wrote:

“I know Uber has the image of an obnoxious digital robber baron, a company that plays dirty tricks and proves that convenience “makes hypocrites of us all,” as John Naughton put it in The Guardian, noting that its very name has connotations of Nietzschean superiority. (Travis Kalanick, the C.E.O., coined the word “Boob-er” to describe his greater appeal to women because of his success.)”

Actually, even if Ms Dowd hadn’t mentioned me I would have rated her column highly because she highlights one of the odder aspects of the Uber phenomenon. She was puzzled because when she tried to summon a Uber car, most of those in her immediate vicinity immediately headed in the other direction. The explanation was provided by the driver who did pick her up, namely that they had all checked her Uber “rating” and discovered that she only got 4.2 out of 5. (Drivers rate passengers as well as vice versa.) In the end, she learned how this reputation system can be gamed: before you part company with your driver you make a deal: “five for five”.

QED.

A pivotal moment

The resounding ‘Yes” vote in the Irish Referendum on changing the Constitution to allow same-sex marriage is a pivotal moment in the history of my beloved homeland. And in the history of the world too, in a small way, because this is the first occasion in which legal equality has been conferred on non-heterosexuals by a popular vote.

My private expectation was that it would be a narrowly positive vote, and that it would be decided by the urban/rural divide, with the electorates of Dublin, Cork and Galway voting overwhelmingly ‘Yes’ and most of the rural constituencies voting ‘No’. In the event I was completely wrong: only one constituency (Roscommon-South Leitrim) went negative, and that by a small margin. There was still an urban/rural divide, but it was much narrower than I had expected.

Cartoon by Martyn Turner in today’s Irish Times.

What it means (and what the Archbishop of Dublin, Diarmuid Martin, conceded) is that Irish society has finally turned the corner towards secularity. What’s astonishing, in some ways, is that it took so long, especially given how long the revelations about the hypocrisy and criminality of the Catholic church over child abuse have been in the public domain. The idea that this decrepit, decaying institution could pretend to be a guide to morals (not to mention politics) was laughable for decades, but it seems that it is only now that its bluff has finally been called.

In one way, it was bound to happen, for demographic reasons — or what marketing consultants call “biological leakage”, i.e. the remorseless tendency of older people to pass away. But that doesn’t lessen the sense of wonder that it has finally happened. As the Irish Times put it in its First Leader,

“the time when bishops could instruct the Irish people on how to vote has long gone. What we may not have appreciated until now is that being a young, networked society has political consequences that can overturn the cynical conventional wisdom about voting behaviour, turnout and engagement.

This is the first Irish electoral event in which young people have taken the lead and determined the outcome and it has been a bracing, refreshing experience. It had been visible on the streets for weeks in the Yes badges that became ubiquitous during the campaign but it had its most potent and poignant expression in the multitude of young emigrants who came home to vote on Friday. Here, in a single gesture, was all the pathos of separation and longing; an expression of solidarity and belonging; and an enduring loyalty to the nation that had so signally failed them. The tweets from those returning to vote for marriage equality were at once inspiring and heartbreaking, testimony to our failure and their promise.”

The campaign was fascinating because it was, as Noel Whelan put it in the Times, “the most extensive civic society campaign ever seen in Irish politics”. In that sense, it reminded one of the campaign that propelled Obama to the White House in 2008. The people who masterminded it — Brian Sheehan and Gráinne Healey — have shown themselves to be consummate, canny strategists who crafted a campaign that was deliberately open and conversational rather than confrontational. (The chosen theme was: “I’m Voting Yes, Ask Me Why?”)

For me, it was especially cheering to see that a long, lonely and exceedingly courageous campaign by a fellow Joycean, Senator David Norris, had finally born fruit. Writing in the Times today, he recalled the long and winding road “from criminal to equal citizen”:

I have been privileged in my life to follow a remarkable trajectory from being defined into criminality, challenging the criminal law, losing in the High Court and Supreme Courts, finally winning out by a margin of one vote in Europe, seeing the criminal law changed and then starting to build on this basis for human and civil rights for gay people.

Fifty years ago my first boyfriend said to me outside a Wimpy Bar on Burgh Quay: “I love you David but I can’t marry you.” I still remember that all these years later.

Go forward 10 years when, after a debate on decriminalisation, the late Mona Bean O’Cribben remarked vehemently to me: “This isn’t just about decriminalisation. You have a homosexual agenda. You won’t be satisfied until you have homosexual marriage.” I turned to her and said: “What a wonderful idea, thank you very much madam, have you got any other suggestions?”

But there is another, intangible but real, aspect to this vote. One of the strangely positive side-effects of the ‘Celtic Tiger’ years — when the Irish economy zoomed from sensible economic development to casino property-development insanity — was that my fellow citizens experienced for the first time what it was like to be seen as successful by the rest of the world. It was suddenly, as some of them observed at the time, “cool to be Irish”. All of which meant that the bust and the subsequent economic collapse had an even harsher psychic impact: it turned out that we had been kidding ourselves; that we had, as Frank McDonald (the great Irish Times journalist) used to say, “lost the run of ourselves”.

But one of the most unexpected byproducts of Friday’s vote is that we can be genuinely proud of ourselves, and for a reason infinitely better than fuelling a crazed property boom: for once, we did the right thing. Not a bad day’s work.

Why Bitcoin is interesting

This morning’s Observer column:

When the banking system went into meltdown in 2008, an intriguing glimpse of an alternative future appeared. On 31 October, an unknown cryptographer who went by the name of Satoshi Nakamoto launched what he described as “a new electronic cash system that’s fully peer to peer, with no trusted third party”. The name he assigned to this new currency was bitcoin.

Since then, the world has been divided into three camps: those who think that bitcoin must be a scam; those who think it’s one of the most interesting technological developments in decades; and (the vast majority) those who have no idea what the fuss is about.

I belong in the second camp, but I can see why others see it differently…

Criminality, banker style

From a New York Times editorial:

“As of this week, Citicorp, JPMorgan Chase, Barclays and Royal Bank of Scotland are felons, having pleaded guilty on Wednesday to criminal charges of conspiring to rig the value of the world’s currencies. According to the Justice Department, the lengthy and lucrative conspiracy enabled the banks to pad their profits without regard to fairness, the law or the public good.”

The Times goes on to point out, however, that besides the criminal label and the fines, nothing much has changed for the banks. In a memo to employees this week, the chief executive of Citi, Michael Corbat, called the criminal behavior “an embarrassment” — a euphemism for crime that wouldn’t pass muster if it were to be expressed by a person accused of benefit fraud, say.

“As a rule”, the Times continues,

“a felony plea carries more painful consequences. For example, a publicly traded company that is guilty of a crime is supposed to lose privileges granted by the Securities and Exchange Commission to quickly raise and trade money in the capital markets. But in this instance, the plea deals were not completed until the S.E.C. gave official assurance that the banks could keep operating the same as always, despite their criminal misconduct.”

Nor do regulators propose to investigate further, to see if individual members of the banks’ staffs can be identified as perpetrators of the crimes.

It stinks to high heaven. As usual.

Will Hutton: “Criminal bankers have brazenly milked the system. Let’s change it”

Observer Editorial: “Making bankers pay for their misdeeds”

The Internet as a mirror for human nature

From the Guardian today:

I gave a lecture recently in Trinity College, Dublin, in which I said, en passant that the Net holds a mirror up to human nature and what we see in it is pretty unedifying. Items 1, 2 and 4 of this list of what the Guardian team regard as “hot tech stories” makes that point rather well, don’t you think?

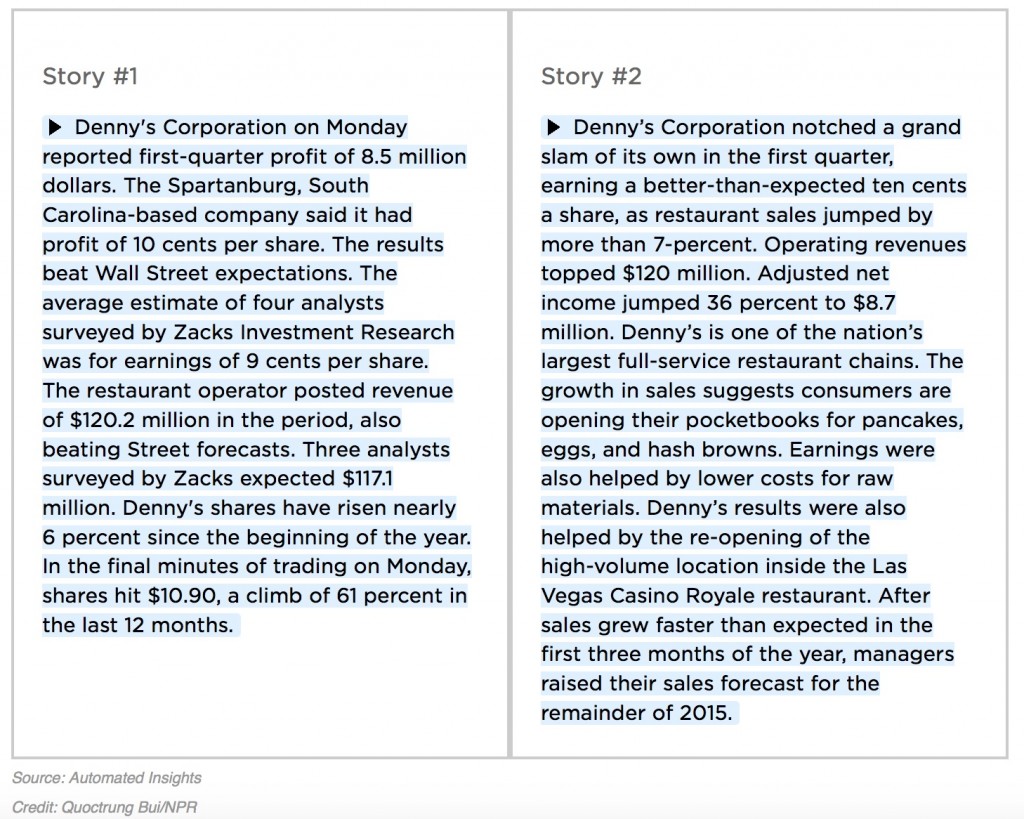

Robotic reporting

This follows on from our seminar on the implications of advanced robotics for employment. Here are two reports based on wire-service reports of a company’s results. One was written by a bot, the other by a human.

It begs two questions:

- Which was which? (Easy, I think).

- More difficult: which is better? More accurate? Good enough?

HT to Andrea Vance for the link.

Mullaghmore

Mullaghmore is one of my favourite spots on the West coast of Ireland. We often stop there and take a walk on the beautiful curving beach with Ben Bulben as a background. It’s also the place where Lord Mountbatten and three family members plus a local boy were murdered by the IRA in 1979. In a significant visit, Prince Charles visited Mullaghmore today. It’s not clear whether he also visited Classiebawn, the castle that was his great-uncle’s holiday home.

Classiebawn is one of the most memorable houses in Ireland. It was built for Lord ‘Gunboat’ Palmerston and is a bit like a Disney castle which sits on what is probably the most exposed headland on the Sligo coast. I once took this photograph of the road to it on a glorious winter’s day. The house is the speck in the top left of the picture.