“Watergate had All The President’s Men. Trump’s version will be All Roads Lead to Putin.”

Linkblog

Sheer genius!

Linkblog

- Anton Howes: The crucial century The mystery of why the industrial revolution started in Britain.

- Michael Kramer’s O-ring theory of development One of the contributions that got him his share of the Nobel prize for economics.

- Trump’s letter to Erdogan Truly, you couldn’t make this up.]

- The University of Washington’s Centre for an Informed Public Now that would be a good idea.

- Should you disclose to an incoming guest that your home has a ‘smart’ speaker? A question that until recently apparently had not occurred to Amazon, Google, Apple or Facebook executives.

Esther Duflo

Esther Duflo is only the second woman to win the Nobel Prize in economics (she shared this year’s prize with Abhijit Banerjee and Michael Kremer). She’s also the youngest recipient of the prize. This is the TED talk she gave in 2010 explaining some of the work which won the prize.

Linkblog

- “The Seductive Diversion of ‘Solving’ Bias in Artificial Intelligence” Trying to “fix” A.I. distracts from the more urgent questions about the technology.

- Unpacking “Ethical AI”: a curated reading list

- Defending our data: Huawei, 5G and the Five Eyes

- Sully Sullenberger’s letter to the Editor of New York Times Magazine about the Boing 737 MAX Since he’s the pilot who safely landed his airliner in the Hudson River all those years ago, it’s worth paying attention.

Linkblog

- Bill Gates met with Jeffrey Epstein many times, despite his past. Uncharacteristically foolish and naive.

- Is Amazon Unstoppable? For the moment, probably yes.

- Dining with Stalin Not good for your health.

- Limiting forwarding on WhatsApp slowed disinformation

- Benedict Evans on ‘New Productivity’

India is suddenly wary about sharing research with China

Well, well. This from Times Higher Ed Supplement:

Despite rolling out the red carpet for Chinese President Xi Jinping last week, India seems to be pulling away from China when it comes to science and research. Indian universities have been informed that all academic cooperation with China must be approved by the Ministry of Home Affairs and the Ministry of External Affairs, “in addition to other clearances”. Analysts speculate that the growing distance between the countries’ scientific achievements and economic power has made India more tentative about sharing its talent.

Not sure I’d like a government department to be deciding what kind of research I can do and with whom, but this is an interesting straw in the wind.

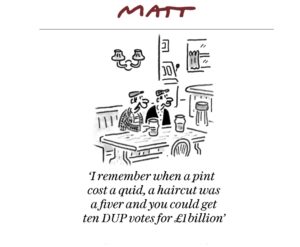

Quote of the Day

“Belief in the corruptibility of all institutions leads to a dead end of universal distrust. American democracy, all democracy, will not survive a lack of belief in the impartiality of institutions; instead, partisan political combat will come to pervade every aspect of life.”

Francis Fukuyama

Our Burkean moment

Robert Shrimsley has a thoughtful column (sadly, behind a paywall) in today’s Financial Times. The headline is “Parliament is fighting a cynical betrayal myth” and it’s about the many MPs who, on various sides of the Brexit debate (though mostly on the anti-Brexit side) have shown amazing principle and moral courage in standing up for their beliefs, in spite of the baying of the mob, tweeted death threats, etc.

It’s strange to see how warped the public discourse (fuelled by some of the worst tabloids in the world) has become, complete with hysteria about “the will of the people” (as expressed in a 52-48 vote) and Parliament “frustrating” said will. There is also talk, inside as well as outside Parliament, about how ‘dysfunctional’ it is. The Attorney General, no less, called it a “disgrace”, devoid of the “moral right” to sit on its green leather benches.

An astonishing level of ignorance — wilful or otherwise — underpins this abusive discourse, which is based on a fundamental misapprehension — that the UK is a republic, banana or otherwise. It isn’t: it’s a representative democracy governed by an old convention that its notional ‘sovereign’ (the monarch) does whatever Parliament tells him or her to do. So Parliament is the real sovereign. And Parliament consists of people elected to represent constituencies, not to do their bidding. Which is what many members of the current Parliament are doing. They are exercising their judgement about the Brexit question, while being mindful of what their constituents think. So the system is working as intended, and fanatics braying that MPs are “ignoring the will of the people” completely (and probably deliberately) miss the point.

This issue goes back a long way — to my fellow countryman Edmund Burke, in fact — who was once challenged when standing for election in Bristol. The question at issue was whether an MP was a representative or a mere delegate — someone sent to Parliament to carry out the instructions of his constituents. Burke delivered a famous speech on the question on November 3, 1774. Here’s the core of it:

Certainly, gentlemen, it ought to be the happiness and glory of a representative to live in the strictest union, the closest correspondence, and the most unreserved communication with his constituents. Their wishes ought to have great weight with him; their opinion, high respect; their business, unremitted attention. It is his duty to sacrifice his repose, his pleasures, his satisfactions, to theirs; and above all, ever, and in all cases, to prefer their interest to his own. But his unbiassed opinion, his mature judgment, his enlightened conscience, he ought not to sacrifice to you, to any man, or to any set of men living. These he does not derive from your pleasure; no, nor from the law and the constitution. They are a trust from Providence, for the abuse of which he is deeply answerable. Your representative owes you, not his industry only, but his judgment; and he betrays, instead of serving you, if he sacrifices it to your opinion.

My worthy colleague says, his will ought to be subservient to yours. If that be all, the thing is innocent. If government were a matter of will upon any side, yours, without question, ought to be superior. But government and legislation are matters of reason and judgment, and not of inclination; and what sort of reason is that, in which the determination precedes the discussion; in which one set of men deliberate, and another decide; and where those who form the conclusion are perhaps three hundred miles distant from those who hear the arguments?

To deliver an opinion, is the right of all men; that of constituents is a weighty and respectable opinion, which a representative ought always to rejoice to hear; and which he ought always most seriously to consider. But authoritative instructions; mandates issued, which the member is bound blindly and implicitly to obey, to vote, and to argue for, though contrary to the clearest conviction of his judgment and conscience,–these are things utterly unknown to the laws of this land, and which arise from a fundamental mistake of the whole order and tenor of our constitution.

Parliament is not a congress of ambassadors from different and hostile interests; which interests each must maintain, as an agent and advocate, against other agents and advocates; but parliament is a deliberative assembly of one nation, with one interest, that of the whole; where, not local purposes, not local prejudices, ought to guide, but the general good, resulting from the general reason of the whole. You choose a member indeed; but when you have chosen him, he is not member of Bristol, but he is a member of parliament.

It was true then. And it still is.