The Bee’s-eye view

A Foxglove in our garden, this morning.

Quote of the Day

”Suburbia is where the developer bulldozes out the trees, then names the streets after them.”

- Bill Vaughan

Musical alternative to the morning’s radio news

The Travelling Wilburys | Handle With Care | Concert For George Live | 2002

Long Read of the Day

The Devil’s Dictionary of AI talk

Wonderful compendium by Karen Hao. Think of it as Ambrose Bierce’s take on so-called ‘AI’.

Here’s a sample:

adversary (n) – A lone engineer capable of disrupting your powerful revenue-generating AI system. See robustness, security.

artificial general intelligence (phrase) – A hypothetical AI god that’s probably far off in the future but also maybe imminent. Can be really good or really bad whichever is more rhetorically useful. Obviously you’re building the good one. Which is expensive. Therefore, you need more money. See long-term risks.

audit (n) – A review that you pay someone else to do of your company or AI system so that you appear more transparent without needing to change anything. See impact assessment.

compliance (n) – The act of following the law. Anything that isn’t illegal goes.

democratize (v) – To scale a technology at all costs. A justification for concentrating resources. See scale.

diversity, equity, and inclusion – The act of hiring engineers and researchers from marginalized groups so you can parade them around to the public. If they challenge the status quo, fire them.

ethics board – A group of advisors without real power, convened to create the appearance that your company is actively listening. Examples: Google’s AI ethics board (canceled), Facebook’s Oversight Board (still standing).

for good – As in “AI for good” or “data for good.” An initiative completely tangential to your core business that helps you generate good publicity.

governance (n) – Bureaucracy.

impact assessment – A review that you do yourself of your company or AI system to show your willingness to consider its downsides without changing anything. See audit.

integrity (n) – Issues that undermine the technical performance of your model or your company’s ability to scale. Not to be confused with issues that are bad for society. Not to be confused with honesty.

interdisciplinary (adj) – Term used of any team or project involving people who do not code: user researchers, product managers, moral philosophers. Especially moral philosophers.

partners (n) – Other elite groups who share your worldview and can work with you to maintain the status quo. See stakeholders.

regulation (n) – What you call for to shift the responsibility for mitigating harmful AI onto policymakers. Not to be confused with policies that would hinder your growth.

stakeholders (n) – Shareholders, regulators, users. The people in power you want to keep happy.

transparency (n) – Revealing your data and code. Bad for proprietary and sensitive information. Thus really hard; quite frankly, even impossible. Not to be confused with clear communication about how your system actually works.

value (n) – An intangible benefit rendered to your users that makes you a lot of money.

values (n) – You have them. Remind people.

Lovely! Do read the whole thing.

Where there’s a grille there’s a vent

Absolutely fascinating Guardian piece by Oliver Wainwright on Inventive Vents: A Gazetteer of London’s Ventilation Shafts, a new book that celebrates the disguised vents, shafts and funnels that help London’s underground breathe.

A gas lamp still flickers on the corner of Carting Lane in the City of Westminster, adding a touch of Dickensian charm to this sloping alleyway around the back of the Savoy Hotel. The street used to be nicknamed Farting Lane, not in reference to flatulent diners tumbling out of the five-star establishment, but because of what was powering the streetlamp: noxious gases emanating from the sewer system down below.

The Sewer Gas Destructor Lamp, to give the ingenious device its proper patented name, was invented by Birmingham engineer Joseph Webb in 1895, and it still serves the same purpose today. As a plaque explains, it burns off residual biogas from Joseph Bazalgette’s great Victorian sewer, which runs beneath the Victoria Embankment at the bottom of the lane.

Thanks to Charles Arthur for the link.

How to ask better questions

I’ve often thought that the one thing that marks out the brilliant people I’ve known is that they ask questions that open up areas of inquiry that others have ignored, or been unaware of. A reader of Tyler Cowen’s terrific blog asked him how does he manage to do this. Here’s his reply:

- Highly specific questions are better on average.

- It is often better to preface a question with a confession of some sort, or with information from yourself. That sets a standard for the respondent. Set that standard high!

- Demonstrate credibly that you are truly listening and that you care about the answer.

- With any possible question, ask yourself in advance: can the person being asked the question respond too easily in a vague and not very useful way? “Why did a write a book about Napoleon? Well, let me tell you, French history always fascinated me.” etc. If that is the kind of slop you might get back in response, try making the question more pointed or more specific.

- High status people get better answers than do low status people. So be high status. Or at least credibly pretend to be high status.

- I have enjoyed Gregory Stock’s The Book of Questions.

- You might say “listen to other interviewers.” Well, maybe, but perhaps not too much? They will encourage you, by default, to ask the same questions that everyone else does. And too many of the sources available to you are mega-famous people who are getting by using their fame to boost the significant of their questions. (Anything Oprah might ask me would be interesting per se.) So use this standard tip sparingly and with caution.

- Any questions about all this?

Other, hopefully interesting, links

- Artist Makes Portraits That Age As You Move Around Them. Interesting technique, slightly scary. Link

- Facebook is launching a clone of Substack. This is what Zuckerberg calls ‘innovation’ — basically lifting other people’s good ideas. Link

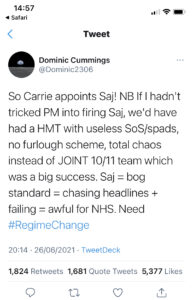

- NASA Chief Says He Believes Aliens Are Real. Of course they are. Hasn’t he ever heard of Rudi Giuliani? Or Dominic Cummings? Link

This blog is also available as a daily email. If you think this might suit you better, why not subscribe? One email a day, Monday through Friday, delivered to your inbox at 7am UK time. It’s free, and there’s a one-click unsubscribe if you decide that your inbox is full enough already!