Welcome!

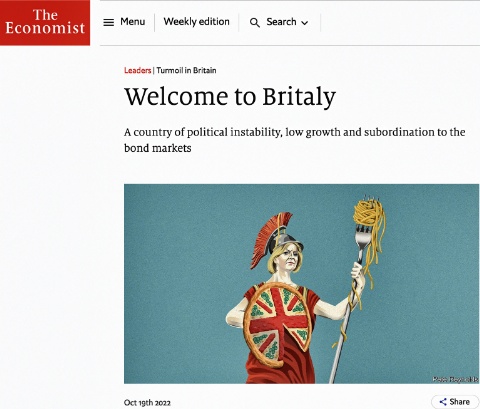

This week’s Economist cover. The magazine has a splendid first Leader on the subject (which, sadly, is probably behind a paywall) which begins thus:

In 2012 Liz Truss and Kwasi Kwarteng, two of the authors of a pamphlet called “Britannia Unchained”, used Italy as a warning. Bloated public services, low growth, poor productivity: the problems of Italy and other southern European countries were also present in Britain. Ten years later, in their botched attempt to forge a different path, Ms Truss and Mr Kwarteng have helped make the comparison inescapable. Britain is still blighted by disappointing growth and regional inequality. But it is also hobbled by chronic political instability and under the thumb of the bond markets. Welcome to Britaly.

The comparison between the two countries is inexact. Between 2009 and 2019 Britain’s productivity growth rate was the second-slowest in the G7, but Italy’s was far worse. Britain is younger and has a more competitive economy. Italy’s problems stem, in part, from being inside the European club; Britain’s, in part, from being outside. Comparing the bond yields of the two countries is misleading. Britain has lower debt, its own currency and its own central bank; the market thinks it has much less chance of defaulting than Italy. But if Britaly is not a statistical truth, it captures something real. Britain has moved much closer to Italy in recent years in three ways…

And those ways are?

- Political instability almost on the Italian scale.

- Italy was the plaything of the bond markets during the euro-zone crisis; now the same markets are “visibly in charge” of Britain.

- Britain’s low-growth problem has become more entrenched.

The analogy is particularly interesting for me. Way back in 1973, Ireland and the UK joined the EEC on the same day. A few weeks afterwards, I was in Dublin and went with a journalist friend to the Horseshoe Bar in the Shelbourne hotel, where the Irish political elite used to gather for pre-dinner drinks and gossip. I asked a TD (the Irish version of MP) what joining the EEC meant to him. “It means”, he replied, “that when an Irish minister goes to Brussels he sits across the table from a British minister (pause) as an equal!”

A couple of months later I was at a political event in London and I asked the same question of a friendly Tory MP. What did joining the EEC mean for him. “It means,” he said, “that we are now just an ordinary country…”. He paused, for emphasis, “just like Italy”.

And here we are. The one piece of good news is that — as the Economist puts it — there is one reason to feel more hopeful about Britain: political instability here is just a one-party disease. “The Tories have become nigh-on ungovernable, due to the corrosion from Brexit and the sheer exhaustion of 12 years in power”. Yep. Which is why the country needs a general election.

Wouldn’t it be nice to know what the country’s new constitutional monarch makes of it all.

Quote of the Day

”The object of war is not to die for your country. The object of war is to make damn sure the other sonofabitch dies for his”.

- General George Patton

Musical alternative to the morning’s radio news

Brahms | Trio in A minor for Clarinet, Cello, and Piano, Op 114, I. Allegro

A much-needed calming influence after reading the latest update on the Westminster circus.

Long Read of the Day

Globalism Failed to Deliver the Economy We Need

Terrific essay By Rana Foroohar.

The neoliberal philosophy is tapped out not only in the United States but also abroad — witness the backlash in Britain to Prime Minister Liz Truss’s ill-fated experimentation with trickle-down tax cuts. Offshoring to multiple countries was supposed to make manufacturing more productive and business more efficient. But many of those supposed efficiencies collapsed with any sort of global stress, from pandemics to tsunamis, port backups and other unforeseen events.

And complex supply chains resulted in any number of production disasters well before the global crises of the past few years; think about the Rana Plaza disaster in Bangladesh in 2013, in which a factory making clothes for various global brands (which had no idea about downstream risk in their supply chains) collapsed and killed over 1,100 people. Meanwhile, free trade itself, which was supposed to foster peace between nations, became a system to be gamed by mercantilist nations and state-run autocracies, resulting in deep political divides at home and abroad.

Fortunately, the pendulum of the political economy eventually swings back, and philosophies that have outlived their usefulness give way to new ones…

I hope she’s right.

How to tax energy companies’ windfall profits

One of the many ironies of the current energy crisis is that although electricity is now much cheaper to generate from renewable sources than that generated by gas-powered stations, nevertheless the renewables companies are getting the same price for their electricity as are the gas generators. Which is why electricity prices have shot up. If you’re as puzzled by this as I was initially, then this explainer by Clemens Fuest and Alex Ockenfels may help.

Books, etc.

I’m reading my way (slowly) through Brad DeLong’s magnum opus, Slouching towards Utopia: An Economic History of the Twentieth Century and hope to write something about it soon. In the meantime, for those who are interested, Diane Coyle has a characteristically insightful review of the book on her blog. Highly recommended.

My commonplace booklet

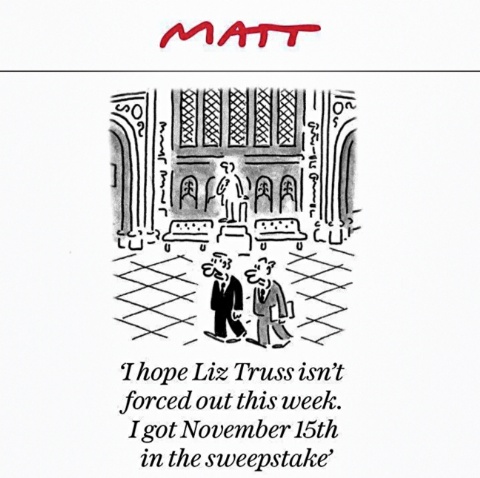

Matt Pritchett is a genius. (And, as I’ve just discovered, also grandson of the writer V.S. Pritchett)

This Blog is also available as a daily email. If you think that might suit you better, why not subscribe? One email a day, Monday through Friday, delivered to your inbox. It’s free, and you can always unsubscribe if you conclude your inbox is full enough already!