For hire

Quote of the Day

“I do not believe in Belief… Lord, I disbelieve — help thou my unbelief.”

- E.M. Forster in Two Cheers for Democracy, 1951.

Musical alternative to the morning’s radio news

Paul Simon & George Harrison | Here Comes The Sun

Long Read of the Day

Tyler Cowen’s conversation with Zach Carter

This will not be to everyone’s taste. But if you’re interested in Keynes (as I am) and if you’ve read Zachary Carter’s splendid new biography then you’ll love it. What’s particularly good is the fact that Cowen is pretty critical of Keynes, so it’s very much an anti-hagiographical conversation.

Here’s a little sample:

COWEN: I have at least 20 different friends who studied The General Theory, Keynes’s book from 1936, the big famous one. I ask them, “What’s the central message of The General Theory?” They all give me different answers, so I’d like to know, what’s your answer? There’s so much in the book, right? Incredibly rich and multifaceted, but what’s the bottom-line core of The General Theory?

CARTER: You love the hard questions. I wrote in the book that the bottom-line core message of The General Theory is that prosperity is not hardwired into human beings, that it has to be guided through political leadership. I think that traces back, to some extent, to what you were just talking about about India. He views the state and the government, from a very early age, as this sort of guiding hand. In the case of India, it’s a bit paternalistic, but also, domestically, he believes that government is a necessary force to organizing human affairs.

The General Theory — it’s a complicated book. In certain respects, it’s not always consistent with itself, but I think that there’s a political message, which is that political guidance is needed for prosperity to exist, for markets to function. There’s also a reevaluation of what economics is doing and how economics functions. Keynes is not focused on scarcity at this point, and I think Michał Kalecki has written about this.

I think this idea that Keynes is refocusing the nature of economics and economic humanity, from competition for scarce resources towards the idea that uncertainty about the future is the most important psychological condition for economics. If you believe in scarcity as the overriding issue, you’re going to come to different conclusions about how the world works than if you believe uncertainty is the overriding issue. I’m not sure which one of those is the most important, but those are the two that I think are key.

Great stuff.

Digital health passports should not be rolled out on a mass basis until COVID-19 vaccines are available to all, report warns

Digital health passports, sometimes also referred to as ‘immunity passports’, are digital credentials that, combined with identity verification, allow individuals to prove their health status (such as the results of COVID-19 tests, and eventually, digital vaccination records).

As the move to ‘return to normal’ strengthens immunity passports will become valuable and sought after for obvious reasons — like enabling you to travel, get a job, go to the theatre or a film perhaps. So you can write the script for what will happen next — and who will get the lion’s share of the certificates. (Hint: it won’t be the deserving poor.) Which is why an interesting new report from Exeter University is timely. It warns that digital health passports should not be introduced on a mass basis until coronavirus tests are available and affordable to everyone in the country. The same considerations apply to vaccines once these are approved and ready for widespread use.

The Report’s central findings are:

Digital health passports may contribute to the long-term management of the COVID-19 pandemic.

• However, digital health passports pose essential questions for the protection of data privacy and human rights, given that they:

• use sensitive personal health information;

• create a new distinction between individuals based on their health status;

• can be used to determine the degree of freedoms and rights one may enjoy.

• Measures supporting the deployment of such digital health passports may interfere with the respect and protection of data and human rights, in particular the rights to privacy, equality and non-discrimination, and the freedoms of movement, assembly, and to manifest one’s religion or beliefs.

• While public health interests may justify such interferences, policymakers must strike an adequate balance between protecting the rights and freedoms of all individuals and safeguarding public interests when managing the effects of the pandemic.

The research was carried out by Dr Ana Beduschi, from the University of Exeter Law School and is funded by the Economic & Social Research Council (ESRC), as part of UK Research & Innovation’s rapid response to Covid-19.

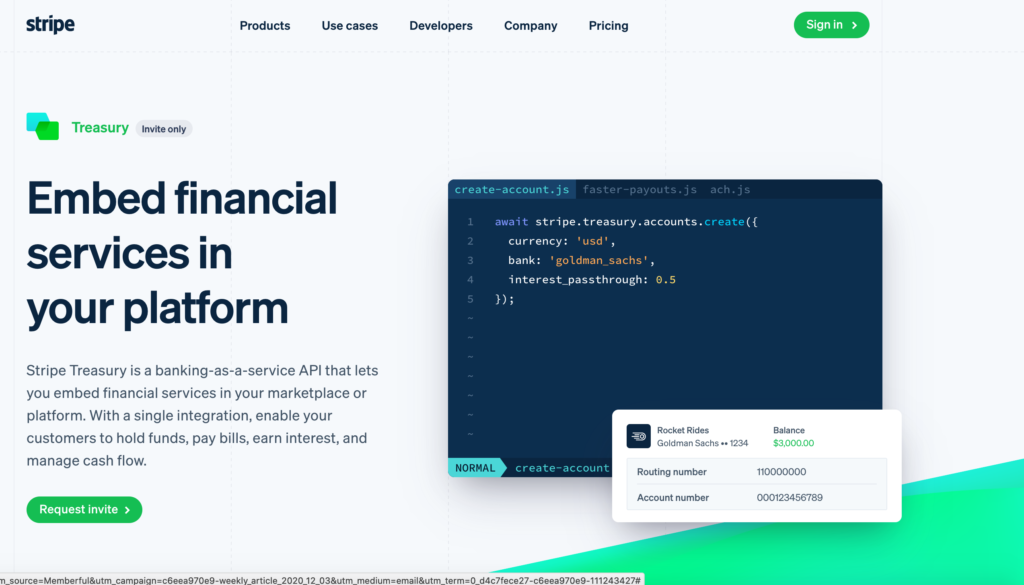

Stripe: the most important company you’ve never heard of

From Bloomberg:

Private financial technology business Stripe Inc. is in talks to raise a new funding round valuing it higher than its last private valuation of $36 billion, according to people familiar with the matter.

The valuation being discussed could be more than $70 billion or significantly higher, at as much as $100 billion, said one of the people, who asked not be identified because the matter is private. That would make it currently the most valuable venture-backed startup in the U.S., according to CB Insights.

Stripe was co-founded in 2010 by two Irish lads — brothers John and Patrick Collison. The pair sold their first company for $5 million when they were teenagers and are now worth about $4.3 billion each, according to the Bloomberg Billionaires Index. Their company currently has more than 2,500 employees and 14 global offices. An ad on its website suggests that it is poised to become much bigger and more important.

Stripe’s software, which competes with Square Inc. and Paypal Holdings Inc., is used by businesses to accept payments (including payments to Substack authors who charge subscriptions for their blogs). But that turned out to be just the boys’ first act.

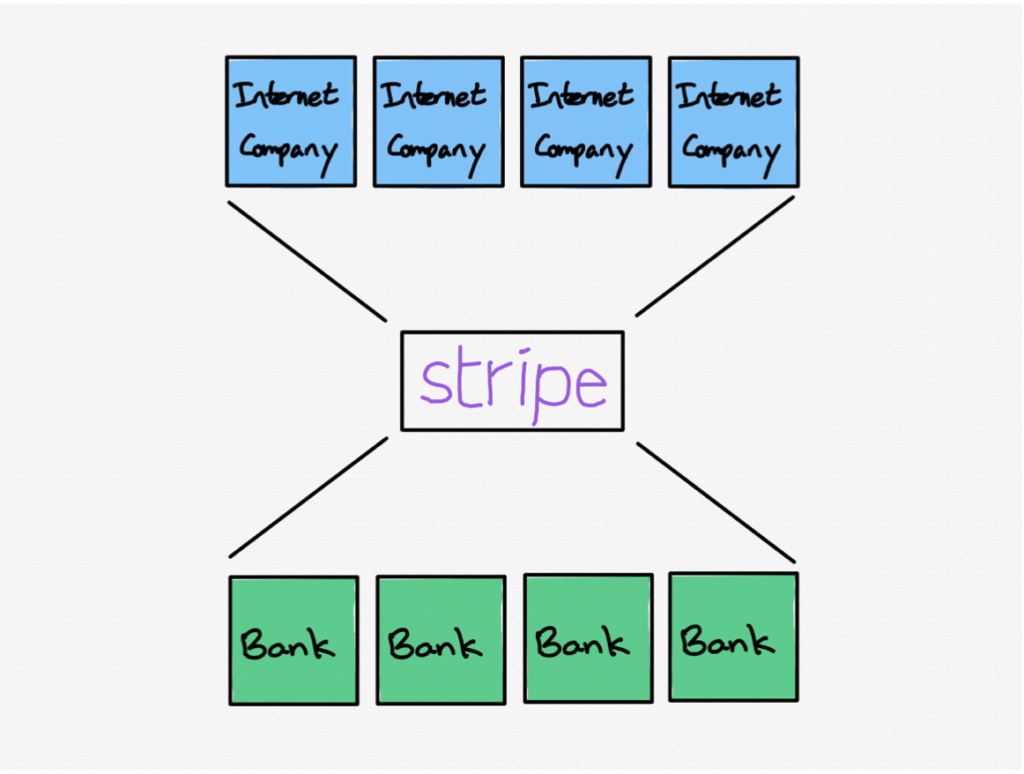

Basically, Stripe now aims to become the central platform for financial transactions on the Internet. This is how the shrewd analyst Ben Thompson graphically summarises it on his daily subscription newsletter.

Watch this space. And, no, you can’t buy shares in it. It isn’t a public company.

Other, hopefully interesting, links

- Think really big bridges don’t vibrate in high winds? Think again. Link

- Boom and Bust wins Enlightened Economist Book of the Year. Link

This blog is also available as a daily email. If you think this might suit you better, why not subscribe? One email a day, delivered to your inbox at 7am UK time. It’s free, and there’s a one-click unsubscribe if your decide that your inbox is full enough already!