Come in!!

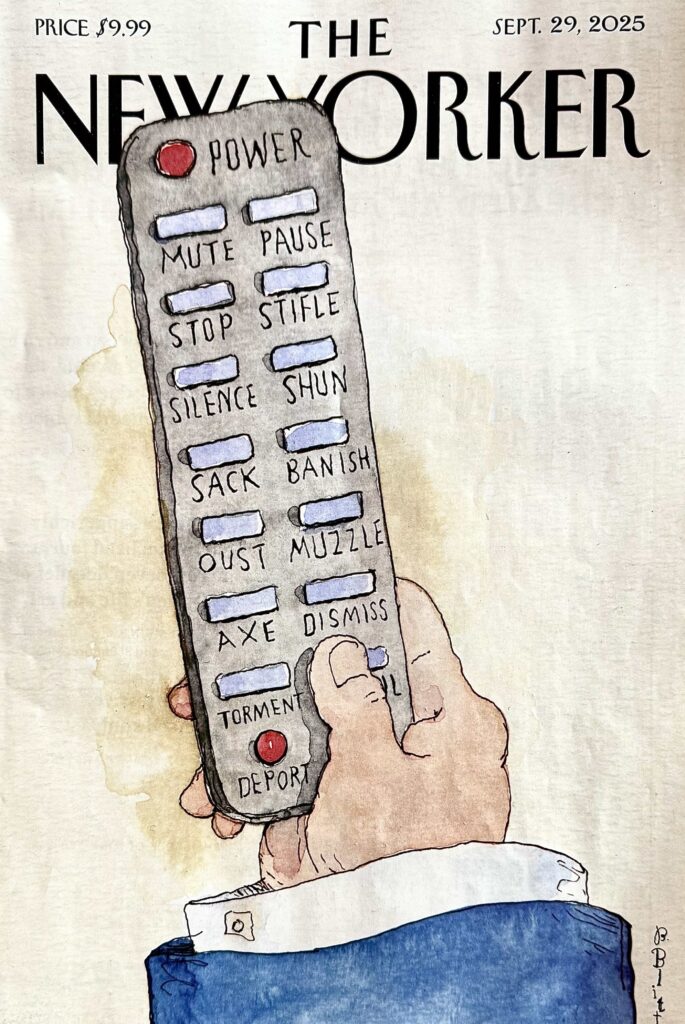

Quote of the Day

“The secret of survival is a defective imagination. The inability of mortals to imagine things as they truly are is what allows them to live, since one momentary, unresisted glimpse of the world’s totality of suffering would annihilate them on the spot.”

- John Banville, in his novel The Infinities

Musical alternative to the morning’s radio news

Handel | I Know that my Redeemer Liveth | Messiah

Long Read of the Day

You Can Look It Up: A threnody for the dictionary

Lovely essay in Commentary by Joseph Epstein.

If you love dictionaries (and who doesn’t?) then this is for you. And Joseph Epstein writes beautifully. Here is is, for example, on Kory Stamper to for 20 years was an Associate Editor at Merriam-Webster.

Kory Stamper’s Word by Word, published in 2017, is an account of how dictionaries are made. Ms. Stamper went to work for Merriam-Webster in 1998, and remained there for nearly 20 years, 10 of them as an associate editor. Merriam-Webster, she informs us, requires no qualification for becoming a lexicographer apart from a college degree and English being one’s first language. But she makes plain that without a love of language, one really isn’t fit for, or likely to last long in, the job. She qualified on this count, too.

Ms. Stamper doesn’t hold with the distinction between prescriptivist and descriptive, at least when it comes to the making of dictionaries. “We don’t just enter the good stuff,” she notes. “We enter the bad and ugly stuff, too. We are just observers, and the goal is to describe, as accurately as possible, as much of the language as we can.” She views Standard English as another dialect, one of many, and writes:

”We think of English as a fortress to be defended, but a better analogy is to think of English as a child. We love and nurture it into being, and once it gains gross motor skills, it starts going exactly where we don’t want it to go; it heads straight for the goddamned electrical sockets. We dress it in fancy clothes and tell it to behave, and it comes home with its underwear on its head and wearing someone else’s socks. As English grows, it lives its own life, and this is right and healthy… . But we can never really be the boss of it. And that’s why it flourishes.”

Lovely stuff.

Footnote. A threnody, according to Merriam-Webster, is “a song of lamentation for the dead”.

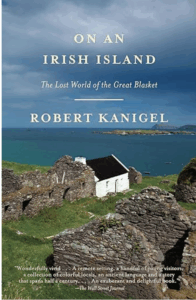

My commonplace booklet

My childhood memories of Christmas are not terribly fond ones, perhaps because my parents weren’t very good at celebrations. But the memory of one particular Christmas Eve remains vivid. I was six or seven years old. We were living in rural Ireland, a country which, in the 1950s, was not unlike rural Poland before the Berlin Wall came down — poor, backward and priest-ridden. One Christmas my parents decided that we would spend the festival at her parents’ home in Mayo, a long way from where we lived in Kerry. They were relatively wealthy, had a large house and a lively household of aunts and uncles, so it was an exciting prospect for me and my siblings.

Since Da’s job required him be in his office in the morning, it was relatively late in the afternoon before all of us — parents, three children and a dog — were ready to squeeze into our Morris Minor and set off to drive northwards as night fell. Soon, we were travelling in total darkness on almost deserted roads. I remember snuggling down under a rug, entranced by the fact that the only light came from the speedometer that constituted the vehicle’s instrument panel and imagining that my father, silhouetted in that faint glow, was the pilot of a plane flying into the darkness of space.

But the memory that most stood out (and remains) was the way that every rural dwelling that we passed in that enveloping darkness had a single lighted candle in its window.

Now, there’s a threnody for you.

This Blog is also available as an email three days a week. If you think that might suit you better, why not subscribe? One email on Mondays, Wednesdays and Fridays delivered to your inbox at 5am UK time. It’s free, and you can always unsubscribe if you conclude your inbox is full enough already!