Well, well. Here we go again. From the Boston Globe:

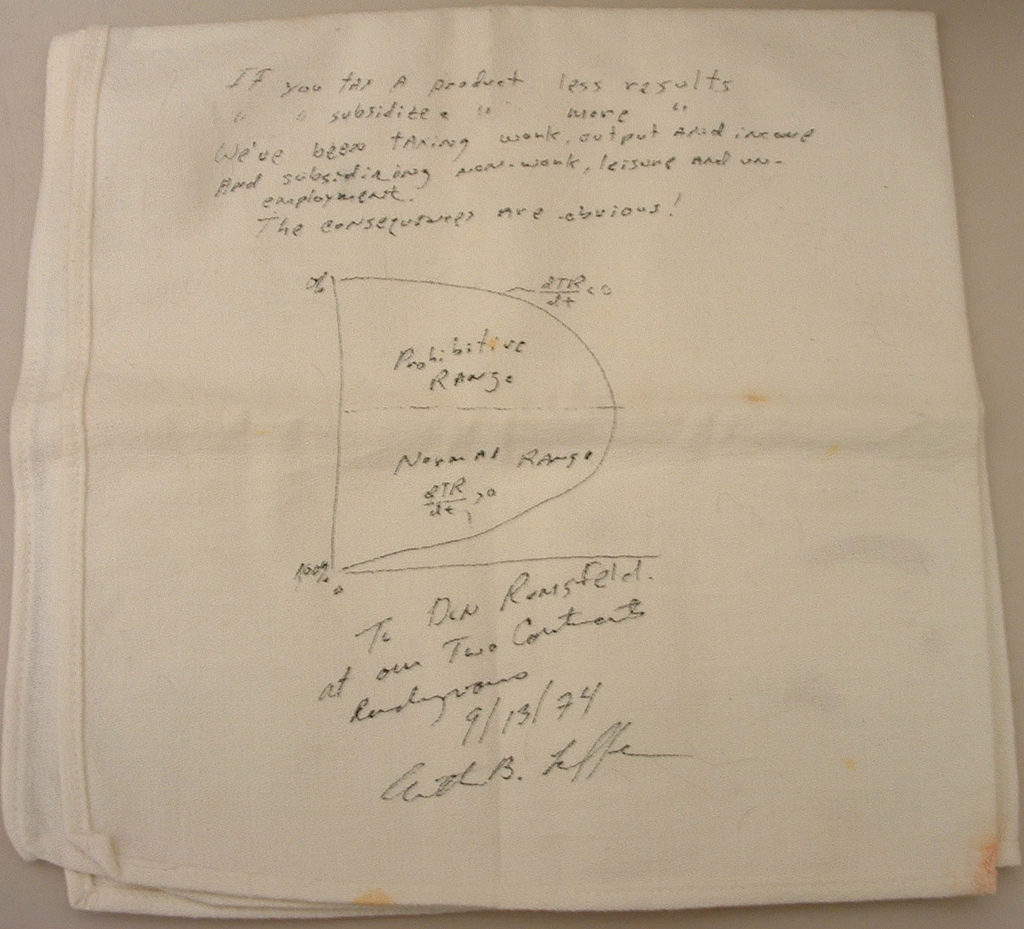

WASHINGTON — A white cloth napkin, now displayed in the National Museum of American History, helped change the course of modern economics. On it, the economist Arthur Laffer in 1974 sketched a curve meant to illustrate his theory that cutting taxes would spur enough economic growth to generate new tax revenue.

More than 40 years after those scribblings, President Donald Trump is reviving the so-called Laffer curve as he is set to announce the broad outlines of a tax overhaul on Wednesday. What the first President George Bush once called “voodoo economics” is back, as Trump’s advisers argue that deep cuts in corporate taxes will ultimately pay for themselves with an explosion of new business and job creation.

Wikipedia says:

The Laffer curve postulates that no tax revenue will be raised at the extreme tax rates of 0% and 100% and that there must be at least one rate which maximizes government taxation revenue. The Laffer curve is typically represented as a graph which starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. The shape of the curve is uncertain and disputed.1

One implication of the Laffer curve is that increasing tax rates beyond a certain point will be counter-productive for raising further tax revenue…

As the Globe observes:

what the president has called a tax reform plan is looking more like a tax cut plan, showering taxpayers with rate reductions without offsetting the full cost by closing loopholes or raising taxes elsewhere. In the short run, such a plan would add many billions of dollars to the national deficit. Trump contends that it will be worth it in the long run.

“The tax plan will pay for itself with economic growth,” Steven Mnuchin, the Treasury secretary and main architect of the plan, told reporters this week.)

Questions: does any serious economist believe this? And isn’t it interesting that the proposed tax cuts will — coincidentally — benefit the Trump family and its subsidiaries?