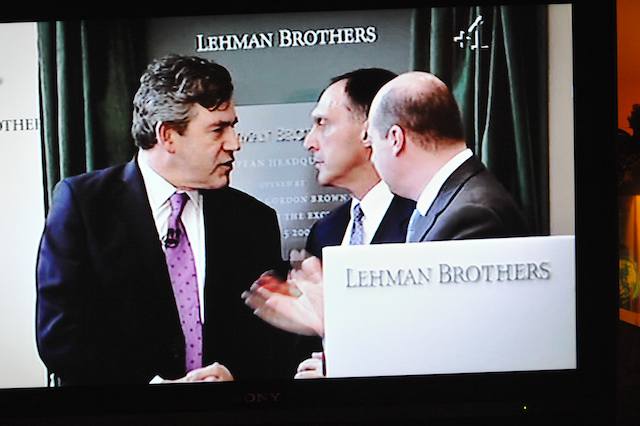

Gordon Brown sucking up to Richard S. Fuld, CEO of Lehman Bros, just after opening Lehman’s new London HQ. Photograph from tonight’s ‘Dispatches’ on Channel 4.

Terrific FT.com column by John Kay.

What would have happened if the Financial Services Authority or Bank of England had sought to block the competing bids from RBS and Barclays for ABN Amro – a contest which, we now know, would bankrupt the bank that won the race? The phones in Downing Street would have been ringing insistently and it is easy to imagine the government’s response.

Little has changed. The government continues to see financial services through the eyes of the financial services industry, for which the priority is to restore business as usual. For a time in 2008, it seemed possible to argue that a package of temporary support for the banking industry, combined with substantial recapitalisation of the weaker players, might stabilise the financial sector and prevent serious knock-on effects.

But the problems of banks are much deeper than were then acknowledged and the destabilisation of the real economy has happened anyway. Government now provides taxpayers’ money to financial services businesses in previously unimaginable quantities. But there is no control over the use of the money, no insistence on structural reform or management reorganisation, no safeguarding of the essential economic functions of the financial services industry and no accountability for the damage that has been done.

It is as though the teenage children and their friends were to wreck the house and then demand that the grown-ups clean up before the next party. Their parents are too intimidated to do anything more than ask Uncle Adair to keep an eye on them and excoriate the hapless Fred who made off with some of the silver.