James Carville, Bill Clinton’s masterful campaigning guru, once said this:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

He said that in 1993 and, to be honest, I didn’t really know what he meant at the time. Now we all understand it, as we watch our (European) governments cringe in terror as they endlessly speculate how to tailor economic policy to appease the bond market. The fact that this is daft should have been well known ever since Keynes’s General Theory, which appeared in 1936, but it seems to have escaped our leaders.

Discussing the behaviour of rational agents in a market, Keynes used the analogy of a newspaper beauty contest in which readers are shown photographs of women and asked to choose a set of the six “most beautiful”. Readers who pick the most popular face are eligible for a prize.

The naive strategy is simply to choose the pictures one finds most beautiful. A more sophisticated strategy is to increase one’s chances by picking the women whose images conform to conventional or popular theories of attractiveness. An even more sophisticated strategy is to choose the women that one thinks the other competitors will regard as the most attractive. And so on, in every-ascending levels of abstraction.

So, Keynes writes,

“It is not a case of choosing those that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

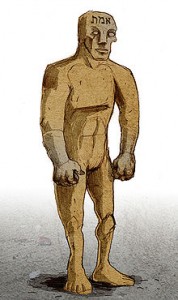

Our governments appear to view the bond market as if it were a Golem — “an animated anthropomorphic being, created entirely from inanimate matter” (Wikipedia) — whereas in fact it’s much closer to Keynes’s beauty contest. Which means that trying to placate the Golem is a fatuous, nay witless, enterprise, for the simple reason that the bond market isn’t a Golem. It’s something quite, quite different — and much more complex.

Interestingly, journalism has been remarkably uncritical of governments’ hallucinations about the Golem. It’s not clear why this has been so. Maybe it’s perhaps most hacks have no idea of how the bond market works. (Our media showed the same fatal lack of curiosity about the ratings agencies in the run-up to the banking crash, btw.) Or perhaps it’s because editors think that readers and audiences aren’t interested in such arcane stuff.

Whatever the explanation, the New York Times broke some welcome new ground today with a fine piece by Katrin Bennhold in which she tried to explain what actually goes on in the bond market and how its traders view the world.

The bond market has emerged as a mighty protagonist in Europe’s economic crisis, representing a seminal shift in power from politicians to investors and a relatively obscure cohort of bankers. Their collective day-to-day judgment can now topple governments and hold the key to the survival of the euro.

If that market seems an unfathomable Goliath to outsiders, in interviews bond traders themselves confessed to being fearful and confused.

Some of the traders to whom Ms Benhold spoke said that they worry that too many of their colleagues lack the skills to decipher conflicting signals from Europe’s leaders in an industry ever more dependent on perception and political guesswork. The short-term fluctuations of bond rates, they concede, are not always an accurate reflection of value and risk. Yet traders are being taken as the last word by politicians on any range of government policies — and are often misinterpreted, they said.

“We used to be able to measure everything to the nth degree,” said Tim Skeet, managing director of fixed income at the Royal Bank of Scotland. “These days, nothing is measurable. This has become less about number-crunching and more about the oracle of Delphi.”

Economists tend to treat the bond market as a rational player imposing budget discipline on politicians. Politicians portray it as having the conscience of a mob, accusing “bond vigilantes” of undermining Europe’s recovery and its cherished welfare state. The reality is more nuanced.

That sounds right to me.

And then there’s the pernicious positive feedback loops built into the situation.

With so much leverage at its disposal, the bond market’s judgments can have the power of prophecy — that is, they can be self-fulfilling, influencing events even as traders assess them from the trading floor.

If investors and traders judge Spanish bonds to be risky because Spain’s government may default, they help make it more likely that Spain will indeed default, by raising its borrowing costs.

“Whatever the Spanish government does — and it has done a lot — it doesn’t actually help much, because the market is pretty much convinced a full-fledged bailout is required,” said Nicholas Spiro, managing director of Spiro Sovereign Strategy, a consulting firm in London that specializes in sovereign credit risk.

Great piece, worth reading in full.

Footnote: Carville is a great source of pithy quotes. For example:

“Republicans want smaller government for the same reason crooks want fewer cops: it’s easier to get away with murder.”