Einstein defined insanity as repeatedly doing the same thing and expecting a different outcome. I was reminded of this when reading Paul Krugman’s piece in the New York Review of Books.

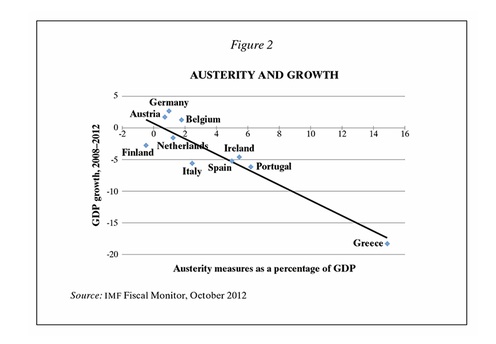

The turn to austerity after 2010, however, was so drastic, particularly in European debtor nations, that the usual cautions lose most of their force. Greece imposed spending cuts and tax increases amounting to 15 percent of GDP; Ireland and Portugal rang in with around 6 percent; and unlike the half-hearted efforts at stimulus, these cuts were sustained and indeed intensified year after year. So how did austerity actually work?

The answer is that the results were disastrous—just about as one would have predicted from textbook macroeconomics. Figure 2, for example, shows what happened to a selection of European nations (each represented by a diamond-shaped symbol). The horizontal axis shows austerity measures—spending cuts and tax increases—as a share of GDP, as estimated by the International Monetary Fund. The vertical axis shows the actual percentage change in real GDP. As you can see, the countries forced into severe austerity experienced very severe downturns, and the downturns were more or less proportional to the degree of austerity.

There have been some attempts to explain away these results, notably at the European Commission. But the IMF, looking hard at the data, has not only concluded that austerity has had major adverse economic effects, it has issued what amounts to a mea culpa for having underestimated these adverse effects.

It’s patently obvious that the current policy of ‘austerity’ isn’t working, and yet our governments are hell-bent on continuing with it. Madness on stilts.