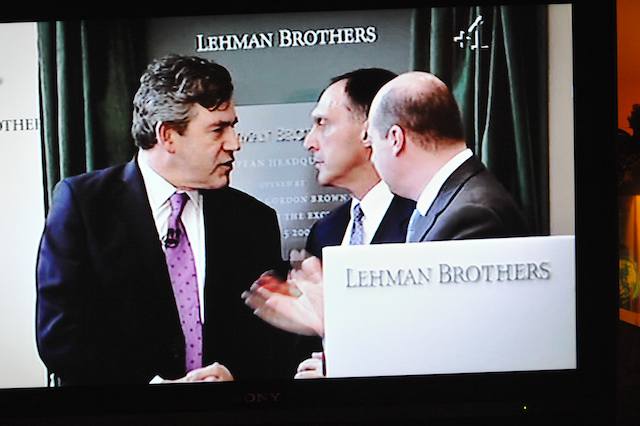

This picture of Gordon Brown sucking up to Richard S. Fuld, CEO of Lehman Bros, just after opening Lehman’s new London HQ, is a still from a Channel 4 ‘Dispatches’ film about the banking collapse. It’s a useful reminder of how much the British and US administrations were in thrall to the bankers who engineered the meltdown of the financial services industry.

The first anniversary of the Lehman collapse is a deeply depressing one, because I see little evidence that anything has changed, or that any real lessons have been learned. But who am I to say? — I don’t have any expertise in the area. Joe Stiglitz, however, does. (He has a Nobel Prize in economics.) And here’s what he has to say in today’s Guardian:

Unquestionably we should not have allowed banks to become so big and so intertwined that their failure would cause a crisis. But the Obama administration has created a new concept: institutions too big to be resolved, too big for capital markets to provide the necessary discipline. The perverse incentives for excessive risk-taking at taxpayers’ expense are even worse with the too-big-to-be-resolved banks than they are at the too-big-to-fail institutions. We have signed a blank cheque on the public purse. We have not circumscribed their gambling – indeed, they have access to funds from the Fed at close to zero interest rates, and it appears that “trading profits” have (besides “accounting” changes) become the major source of returns.

Last night Barack Obama defended his administration’s response to the financial crisis, but the reality is that a year on from Lehmans’ collapse, it has failed to take adequate steps to restrict institutions’ size, their risk-taking, and their interconnectedness. Indeed, it has allowed the big banks to become even bigger – just as it has failed to stem the flow of profligate executive bonuses. Obama’s call on Wall Street yesterday to support “the most ambitious overhaul of the financial system since the Great Depression” is welcome – but the devil, as ever, will be in the detail.

There remain many institutions willing and able to engage in gambling, trading and speculation. There is no justification for this to be done by institutions underwritten by the public. The implicit guarantee distorts the market, providing them a competitive advantage and giving rise to a dynamic of ever-increasing size and concentration. Only their own managerial competence, demonstrated amply by a few institutions, provides a check on the whole process.

At the moment, there seems to be little evidence that people in the financial services industry accept responsibility for the catastrophe they created. An interesting report from the IPPR think-tank puts it nicely:

Financial institutions have also discovered they are not as clever as they thought they were. Keynes said, ‘Practical men,who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist’. In this instance, bankers, hedge funds and the rest were slaves to the economists who told them that people were rational and financial markets efficient. They built complex risk measurement systems, based on these theories, which told them that their positions were safe because they were well-diversified and they ignored the sceptics, such as Nassim Taleb (2007), who warned that these models could not cope with extreme outcomes and, crucially, that these extreme outcomes tend to happen more frequently than statistical models would suggest. However, events have proved Taleb right and the combined wisdom of the financial system wrong.

It seems obvious, therefore, that tomorrow’s capitalism requires a transformation of culture in the City as well as enhanced regulation, as much to save the financial system from itself as to stop it creating another crisis for the rest of the economy. However, it will be very difficult to change this culture. Although there has clearly been a breakdown in trust between the banks and the rest of the economy, there is little to suggest that the City accepts it was responsible and that it has a major role to play in restoring trust. For example, after Goldman Sachs reported a $3.44 billion profit for the second quarter of 2009, there was speculation that average pay␣(salary and bonuses) at the firm would be $1 million this year.

However, City practitioners are not solely to blame. There has also been a massive failure of accountability, which allowed bankers to do what they did. Remuneration committees did not control bank executives through appropriate packages. Auditors did not sound alarm bells over what banks were doing. Institutional shareholders failed to question banks’ behaviour — indeed they egged them on, for example supporting the RBS board’s decision to buy ABN Amro. And regulators failed to appreciate the scale of systemic risk that was developing. The City’s friends were just as culpable as the bankers themselves.

If the City and its supporters are unwilling, or unable, to alter its culture from within, change will have to be imposed on it from without. Some changes seem obvious. Limits should be placed on remuneration packages to ensure they only reward long-term success, not short- term (and unsustainable) gains. And institutional investors, such as pension funds, should think about how they can encourage the City away from its trading mentality and back to a longer-term buy and hold approach.

There will also have to be changes in regulation, since the old rules have been demonstrated to be clearly inadequate. This does not necessarily mean more regulation — the US already has the most heavily regulated financial sector, but this did not stop financial crises developing there. What is needed is better regulation.

Quite. But will we get it? Don’t hold your breath. Obama has already chickened out.