Sitting next to me at last week’s lecture by Simon Hampton of Google was David Cleevely who in addition to being a successful entrepreneur is also the Founding Director of the Cambridge Centre for Science and Policy. At one point, Simon put up a slide showing the percentage of GDP contributed by the Internet in a wide range of European countries. As the animation flashed by David whispered to me: “wonder if there’s a correlation between those percentages and bond yields?” After the lecture, he cycled off purposefully into the gathering gloom. I suspected that he was Up To Something.

He was. Yesterday he and his son Matthew (who’s currently doing a PhD at Imperial College Business School) published this chart on their blog.

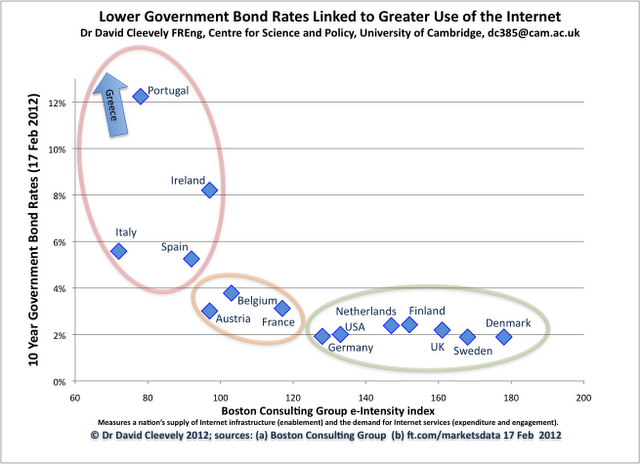

They plotted 10-year governmental bond rates against the Boston Consulting Group’s measure of “e-intensity” for countries in the Eurozone group.

Member states which have not had the capacity to adopt and develop the internet and ecommerce are those with skyrocketing risk premiums on their governments’ debt. These states form a distinct group: Portugal, Italy, Spain, Ireland and Greece (which is literally off the scale) – all with high debt premiums and an e-Intensity score of well under 100.

There are two other groups: those with high e-Intensity and low government bond rates such as Germany, Denmark and the UK, and a middle group (Belgium, Austria and France) with lower e-Intensity (100-120) and raised bond rates of 3-4%.

David and Matthew see two possible (and possibly non-exclusive) explanations for this:

1. Low e-Intensity indicates underlying structural problems: countries with high e-Intensity are those which have invested in modern processes, improved productivity and benefit from strong institutions. These are the countries that have lower borrowing costs, as they are best placed to grow their economies in the future.

and/or

2. e-Intensity (or what it represents) is a fundamental capability: countries which use the internet intensively can respond more flexibly to shocks and crises, instead of being weighed down by cumbersome 20th century processes and institutions.

So…

if you can get a country to invest in, use, and compete on the internet, then you must have either eliminated or minimised any underlying structural problems, or created a flexible and robust economy, or both.

Policymakers, please note.